Cryptocurrency miner Marathon Digital (NASDAQ:MARA) produced 825 Bitcoins (BTC-USD) in March, reflecting about a 21% increase compared to the 683 Bitcoins mined in February. Overall, Marathon mined 2,195 Bitcoins in the first quarter, up 74% year-over-year and 41% sequentially. The company attributed the rise in Bitcoin production to its improved hash rate.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Marathon’s operational hash rate, which indicates the computational power being used to mine and process transactions, increased to 11.5 exahashes per second (EH/s), reflecting an impressive 195% year-over-year increase and a 64% jump compared to Q4 2022. The crypto miner is also focused on energizing its previously purchased mining rigs to achieve its target hash rate of 23 EH/s by the middle of 2023.

Further, Marathon highlighted that in addition to enhancing its operational efficiency, it also improved its financial position in Q1 2023. It brought down its debt by $50 million in the quarter. The company ended Q1 2023 with unrestricted cash and cash equivalents of $124.9 million and Bitcoin holdings of 11,466, the market value of which was about $326.5 million on March 31, 2023.

Last month, Marathon reported its full-year 2022 results, including restated numbers for 2021. The company’s losses increased to $686.7 million in 2022 compared to $37.1 million in the prior year due to several reasons, including a significant plunge in the price of Bitcoin, higher energy costs, and impairment charges related to mining rigs and advances to vendors. Marathon restated its results after the SEC identified certain accounting errors.

Is MARA a Good Stock to Buy?

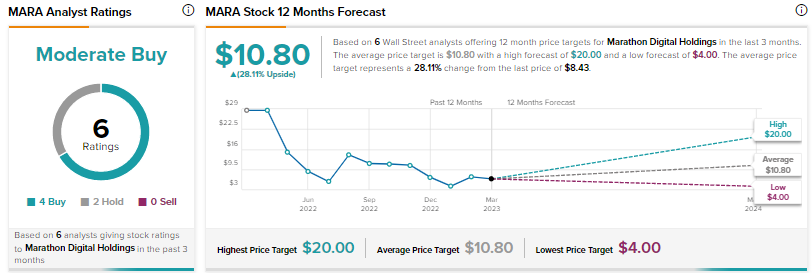

MARA shares have rallied nearly 148% since the start of this year. The average price target of $10.80 implies 28.1% upside. Wall Street’s Moderate Buy consensus rating for Marathon is based on four Buys and two Holds.