The ongoing saga over the potential sale of the Manchester United soccer team (NYSE:MANU) took some new twists today, and investors were alarmingly happy about it. Manchester United surged nearly 7% at one point in Thursday afternoon’s trading, and it all came down to one keyword: exclusivity. Earlier in the day, several sources reported that Manchester United was negotiating directly with one of the two main buyers in the hunt for the time, Qatar’s Shiekh Jassim. Jassim and his consortium were poised to offer over $6 billion for the team outright and buy the entire package out from the current owners, the Glazer family.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Further word from Reuters noted that the Glazers seemed to prefer Shiekh Jassim’s offer over that of Jim Ratcliffe’s, a British billionaire who was offering a bit less but wasn’t planning to buy the whole team. Within hours of those sources suggesting exclusivity was on the table, the BBC brought out a report of its own noting that exclusivity was, actually, not on the table at all. Manchester United denied any notion of exclusivity, with Shiekh Jassim or otherwise, and Jim Ratcliffe was apparently still in the hunt. Had the exclusivity arrangement gone through, Ratcliffe—and anyone else who might still want in—would be out of the proceedings for as long as the exclusivity period went.

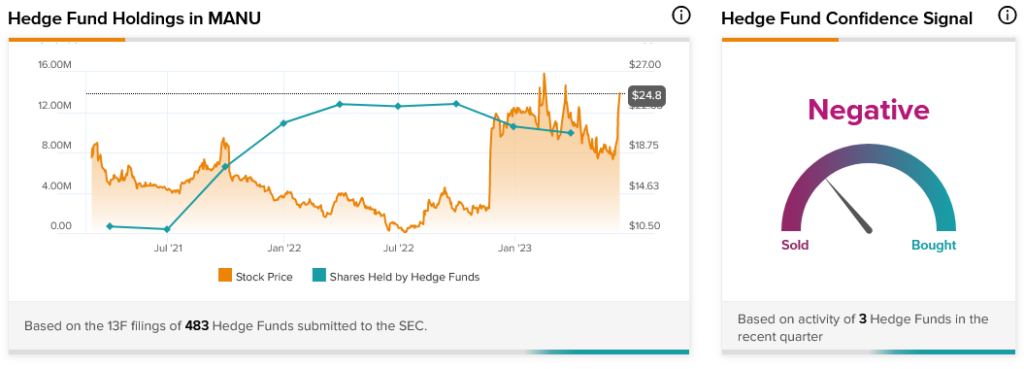

Yet even as investors cheered today, one investor class, in general, has been on the decline: hedge funds. Hedge fund confidence in Manchester United is currently considered “Negative” after selling off 643,100 shares over the course of a quarter. It’s also the second consecutive quarter that hedge funds have sold off shares in Manchester United.