ViacomCBS (VIAC) is a global media and entertainment company. It produces films and television shows, operates broadcast and cable television networks, and offers online video stream services. Its brands include CBS, MTV, Showtime, Nickelodeon, Pluto TV, and Paramount Pictures.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

For Q4 2021, ViacomCBS reported a 16% year-over-year rise in revenue to $8 billion and exceeded the consensus estimate of $7.5 billion. It posted adjusted EPS of $0.26, which declined from $1.04 in the same quarter the previous year and missed the consensus estimate of $0.43.

ViacomCBS plans to distribute a quarterly cash dividend of $0.24 per share on April 1. It has set March 14 as the ex-dividend date.

With this in mind, we used TipRanks to take a look at the risk factors for ViacomCBS.

Risk Factors

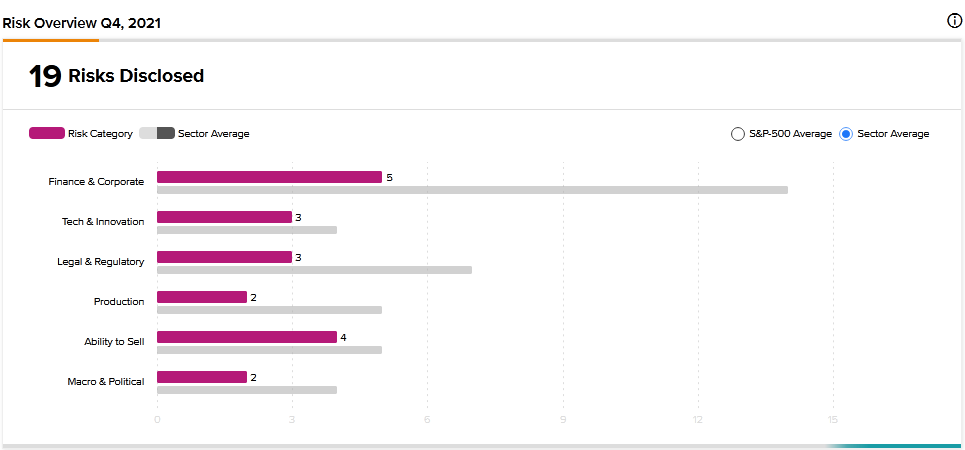

According to the new TipRanks Risk Factors tool, ViacomCBS’ main risk category is Finance and Corporate, with 5 out of the total 19 risks identified for the stock. Ability to Sell and Tech and Innovation are the next two major risk categories with 4 and 3 risks, respectively. ViacomCBS has recently added one new risk factor and updated several previously highlighted risk factors.

In the newly added risk factor, which falls under the Finance and Corporate category, ViacomCBS cautions that the investments it is making may not achieve the expected outcomes. It explains that it continues to invest in new businesses, products, and technologies through acquisitions and other initiatives. The company warns that the investments may bring unexpected liabilities, divert management’s attention, and affect existing relationships with advertisers, suppliers, and viewers.

In an updated risk factor, ViacomCBS tells investors that National Amusements owns more than 77% of the voting shares in the company. This means that shareholders whose interests may differ from National Amusements’ are unable to influence actions that require majority support.

In another updated risk factor, ViacomCBS tells investors that it relies on a limited number of distributors for a significant portion of its revenue. Therefore, it cautions that a loss of distribution agreements could have a significant adverse impact on its business, operating results, and financial condition.

Furthermore, the company warns that its business could be harmed if it has to renew existing agreements on less favorable terms. Moreover, ViacomCBS cautions that the consolidation of certain television stations could result in the remaining television distributors having more negotiating leverage.

Analysts’ Take

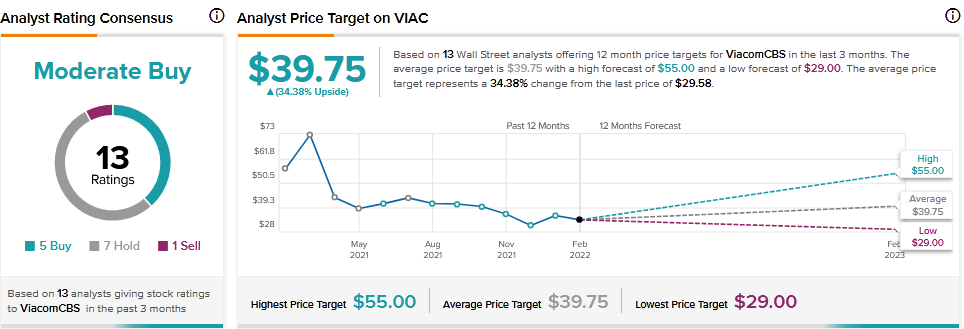

Bank of America Securities analyst Jessica Reif Cohen recently downgraded VIAC stock to a Hold from a Buy. The analyst also lowered the price target to $39 from $53. The reduced price target still suggests 31.85% upside potential.

Cohen explained that the previous bullish thesis was mostly based on ViacomCBS being a potential takeover target amid industry consolidation. While ViacomCBS may still be an attractive target, a potential sale does not appear imminent considering the company’s near-term streaming goals.

Consensus among analysts is a Moderate Buy based on 5 Buys, 7 Holds, and 1 Sell. The average ViacomCBS price target of $39.75 implies 34.38% upside potential to current levels.

Download the TipRanks mobile app now.

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

Volta Trucks Raises $260M to Accelerate Electric Truck Production

Understanding Colgate-Palmolive’s Risk factors

Ryder Enters $300M Accelerated Share Repurchase Program