E-commerce and cloud titan Amazon (AMZN) has seen its share price decline by over 20% from its all-time highs recorded in February 2025. However, this pullback seems more symptomatic of broader market sentiment triggered by Trump’s tariff announcements, which have stoked fears of a trade war and potential economic slowdown. With the company set to report earnings tomorrow, Wall Street market analysts are keenly anticipating continued resilience from one of the world’s most iconic brands.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

While trade tariffs are expected to compress margins in Amazon’s e-commerce division, the company’s broader business outlook remains compelling, underpinned by strong performance in its cloud and AI segments. As such, Amazon continues to warrant a Buy rating with risk-loving buy-the-dip specialists able to acquire AMZN stock at multiples not seen since 2023.

Q1 Earnings Expectations

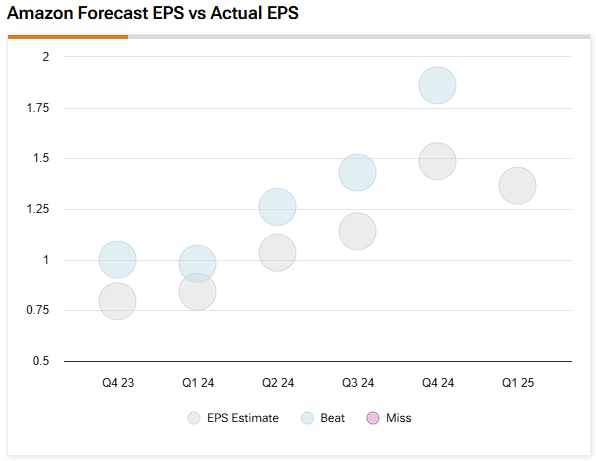

Amazon is set to report its first-quarter results tomorrow, with analysts anticipating earnings per share (EPS) of $1.36, reflecting a robust 39% increase year-over-year. Revenue is projected to reach around $155 billion, at the higher end of Amazon’s guidance range of $151 billion to $155.5 billion, representing 8% year-over-year growth.

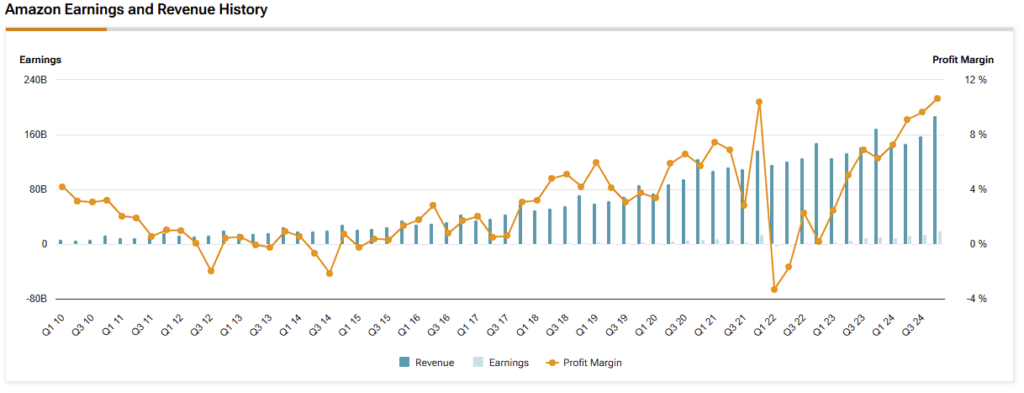

Looking back, Amazon reported strong Q4 results on February 6. Adjusted EPS came in at $1.86, surpassing the consensus estimate of $1.49 and soaring 86% from $1.00 in the prior year. Revenue rose 10% year-over-year to $188 billion, while operating income surged 61% to $21.2 billion.

Trade War and Tariff Headwinds

President Trump’s reciprocal tariffs—ranging from 10% to 50% on imports from several countries—has sent ripples across global markets. Notably, a 34% tariff has been levied on Chinese goods, prompting a mirror response from China on U.S. imports.

While the long-term consequences of the tariff and its impending changes (resulting from economic and political pressure) will unfold in the coming months, let’s examine what it means for Amazon.

Given that over half of the items sold on Amazon’s marketplace are manufactured in China, these tariffs may dampen Amazon’s e-commerce sales. To maintain its dominant market share, Amazon may be forced to reduce prices, thereby pressuring e-commerce margins. While the company could eventually diversify its sourcing strategy away from China, this transition may take several quarters to materialize.

AWS and AI Growth to Mitigate Tariff Impact

Despite near-term headwinds in e-commerce, Amazon’s future is not tethered to tariffs alone. The long-term growth narrative remains intact, fueled by continued momentum in its cloud and AI businesses.

Amazon maintains its leadership in the cloud computing sector, commanding over 30% market share despite stiff competition from Microsoft’s (MSFT) Azure. AWS continues to be Amazon’s most profitable segment, contributing over half of the company’s operating income.

In Q4, AWS posted 19% year-over-year revenue growth, primarily driven by increased demand for its AI-powered services. AWS now operates at a $115 billion annual run rate, and its operating margin expanded significantly to 36.9% from 29.6% a year earlier.

In 2024, Amazon successfully embedded AI across its operations following years of strategic investment. At its AWS Reinvent 2024 conference, the company unveiled a bold AI roadmap, including plans to build a supercomputer powered by its proprietary Trainium chips, designed to compete with Nvidia’s (NVDA) dominant GPUs.

AI is poised to remain Amazon’s central growth engine, reinforcing its role as a core pillar in its long-term strategy. While e-commerce margins may come under pressure due to tariffs, mid-to-high-teens revenue growth and expanding margins in AI-driven AWS should provide a meaningful offset, making the current stock weakness a compelling entry point for long-term investors.

AMZN’s Attractive Valuation Backed by Cash Warchest

Given Amazon’s multifaceted business model, its EV/EBITDA ratio offers a more comprehensive valuation metric. Historically, Amazon has traded at premium multiples; however, the stock currently trades at just 12.3x forward EV/EBITDA—well below its five-year average of 19.4x, indicating a sizable 36% discount.

For comparison, Amazon trades at a price-to-sales (P/S) ratio of 2.9x. In contrast, cloud computing and tech giant Microsoft trades at a P/S of 10.5x, while social networking company Meta Platforms trades at a P/S of 7.5x.

Additionally, Amazon’s financial foundation remains exceptionally strong. In FY2024, the company reported over $100 billion in cash and short-term investments, along with $33 billion in free cash flow, even after allocating $83 billion in capital expenditures, primarily aimed at advancing its AI initiatives.

Therefore, the stock trades at an attractive valuation with rock-solid business fundamentals. Given the strong growth potential across various business verticals, the current valuation level presents a great buying opportunity.

What is the AMZN Target Price?

Wall Street analysts are overwhelmingly bullish on Amazon despite recent stock weakness. AMZN stock carries a Strong Buy consensus rating based on 46 Buy, one Hold, and zero Sell ratings over the past three months. AMZN’s average price target of $245.33 implies almost 31% upside potential over the next twelve months.

Amazon’s Long-Term Growth Story Is Intact

While geopolitical tensions and tariff-related headwinds have temporarily weighed on Amazon’s stock, its core growth engines—cloud computing and artificial intelligence—remain firmly in place. The company’s dominant position in AWS, AI-driven innovation, and robust financial health position it well for sustainable long-term growth. In light of the current valuation and long-term potential, Amazon stock represents an attractive buying opportunity, regardless of near-term fluctuations post earnings or macroeconomic concerns.