Major tech companies have displayed resilience in their Q1 results, thanks to cloud computing and a few consumer-focused products like the iPhone. Microsoft (MSFT) got a big boost from its cloud computing efforts, while Meta Platforms (META) and Google (GOOG) (GOOGL) reaped the rewards of steady advertising trends. Even with a shaky global economy, Apple (AAPL) enjoyed solid demand for its iPhone. Analyst Dan Ives from Wedbush Securities points out that the shift from financials to the tech sector has created a comforting “safety trade” tailwind for the market.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

On the flip side, companies that have had a rough time in the past may not do as well. Ives singled out Snap (SNAP), Lyft (LYFT), and Cloudfare (NET) as businesses facing uphill battles. However, companies like Google and Microsoft have capitalized on the growing excitement around artificial intelligence. Tech firms are also zeroing in on cost-cutting, which has struck a chord with investors. As for the rest of the year, Ives forecasts that the tech sector will see a gain of another 10% to 12%.

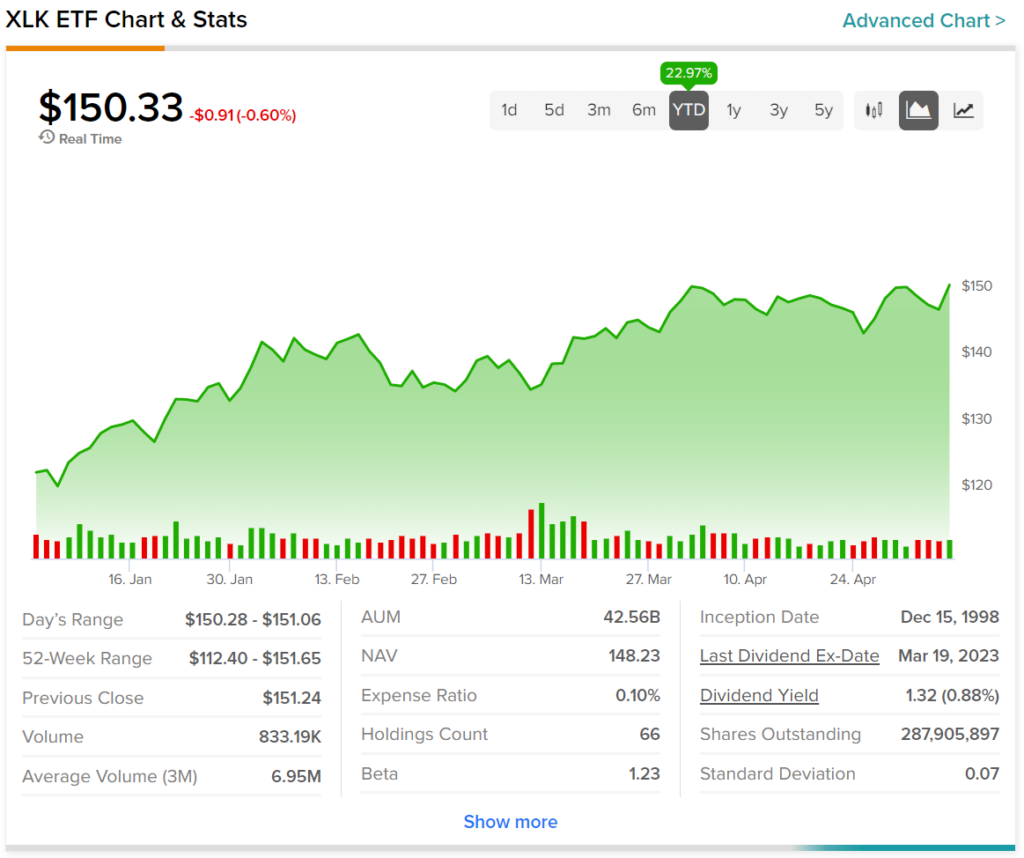

Despite Ives’ positive comments, the tech sector (XLK) is down in today’s trading session. Nevertheless, it has performed very well on a year-to-date basis, gaining almost 23% at the time of writing.