Shares of multi-media company MediaCo Holding (MDIA) gained nearly 22% during the extended trading session on Friday after a major insider scooped up a large chunk of the company’s shares.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

MediaCo has a focus on radio, outdoor, and digital advertising, and owns two radio stations catering to the population of New York City. The company also has about 3,500 outdoor advertisement displays and generates revenue via events.

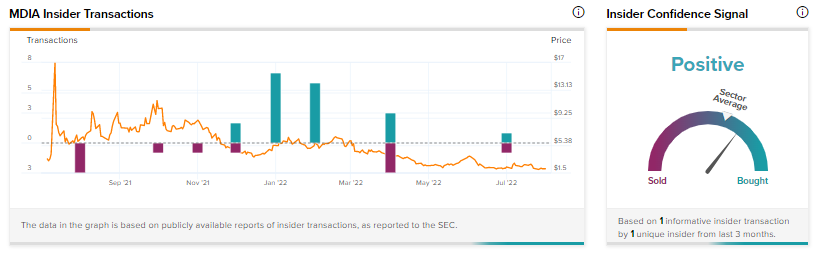

TipRanks data indicates Standard General L.P., which owns over a 10% stake in the company, bought MediaCo shares worth $29.8 million on Friday, indicating positive insider confidence in the stock. Our data indicates that, overall, the five-star insider has had 56% of profitable transactions at an average return of 19.1% over the past 12 months.

The Significance of the Buy

This insider buying comes at a critical time for the company and does well to shore up investor confidence in the stock, which is down 61.3% so far this year.

Earlier this year, MediaCo had received a deficiency letter from Nasdaq as the company was not in compliance with the listing standards based on the market value of securities or stockholders’ equity. Nasdaq also pulled up MDIA for not having a net income of $500,000 from continuing operations in the last few fiscal years.

MediaCo’s plan to regain compliance has been accepted by Nasdaq with an extension until August 31. On July 26, MediaCo gained approval from investors to convert a major part of its outstanding notes into common stock, which would help the company become compliant with the minimum $2.5 million stockholder’s equity requirement.

Bloggers Remain Positive

Although MediaCo’s compliance performance will be monitored by Nasdaq, bloggers in the meantime are Bullish on the stock. TipRanks data indicates that 100% of the bloggers following the stock are Bullish about it, as compared to a sector average of 65%.

Closing Note

Despite positive insider moves and progress towards Nasdaq compliance, MediaCo is not completely out of the woods yet.

The top line has declined over the past two quarters, and a beta of 1.82 means the stock can be volatile amid market gyrations. Furthermore, a price-to-sales ratio of 0.15 means investors are not entirely confident about the stock yet.

Read full Disclosure