Abdiel Capital Advisors, LP, a more than 10% owner of Appian (NASDAQ:APPN) shares, has made significant purchases over the past few days. While Abdiel seems very bullish about the company, Wall Street remains on the sidelines as they continue to be wary of unprofitable companies in a tough macro environment.

Appian provides a “low-code automation platform” that facilitates the creation of high-impact business applications. The company is scheduled to announce its fourth-quarter earnings on February 16. It disappointed investors in November 2022, when it guided for Q4 cloud subscription revenue growth of 24% to 26%, reflecting a slowdown compared to the Q3 growth rate of 30%.

Key Insider Buys Appian Shares

Abdiel recently bought Appian shares in multiple transactions and currently owns about 20 million shares with a holding value of $869.7 million. Most recently, Abdiel purchased 125,000 shares from February 6 to February 8 for a total consideration of about $5.4 million.

As per TipRanks, Abdiel Capital has a 100% success rate based on three transactions, with an average return per transaction of 4.4%.

As per TipRanks’ Insider Trading Activity Tool, the Insider Confidence Signal is Very Positive for Appian based on ten informative insider transactions in the past three months. Overall, insiders have purchased APPN shares worth $58.6 million in the past three months.

Interestingly, TipRanks offers daily insider transactions as well as a list of top corporate insiders. It also provides a list of hot stocks that boast either a Very Positive or Positive insider confidence signal.

Is Appian Stock a Good Buy?

Appian shares have rallied nearly 28% since the start of this year but are still trading at 38% discount to the 52-week high.

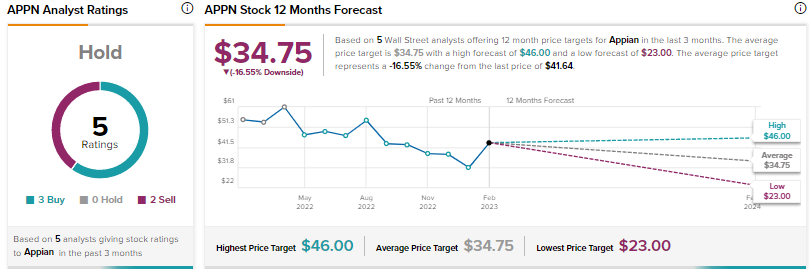

Wall Street is sidelined on Appian, with a Hold consensus rating based on three Buys and two Sells. The average APPN stock price target of $34.75 implies a possible downside of 16.6% from current levels.