There’s good news about advertising technology firm Magnite (NASDAQ:MGNI) today, but you have to look pretty hard to find it. It’s down over 33% in Thursday afternoon’s trading, and that’s where the good news comes in. Earlier today, it was down 40%, so that minor rally represents probably the best news you’ll hear about Magnite stock all day.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The worst part about it all is that Magnite’s second-quarter results weren’t all that bad. In fact, the earnings report itself was a winner. Magnite delivered $0.09 per share in earnings, which is three times what analysts were projecting at $0.03 per share. Revenue was a bit closer to a win, but a win nonetheless. Magnite posted $152.5 million in revenue, while analysts were only looking for $134.3 million. What’s more, that $152.5 million in revenue this quarter was 23.7% higher than the revenue brought in in 2022.

So what caused the plummet that took a third or more of Magnite’s market cap with it? First, there was a one-off problem that meant bigger trouble in other metrics. Magnite’s margin and earnings before interest, taxes, depreciation, and amortization (EBITDA) thanks to the bankruptcy of MediaMath back in late June. MediaMath attempted to sell itself off but couldn’t find buyers in time. Meanwhile, Magnite also cites troubles that it had in the cable television segment since even before the MediaMath bankruptcy. These factors are adding up to bad news in total for Magnite’s near-term operations.

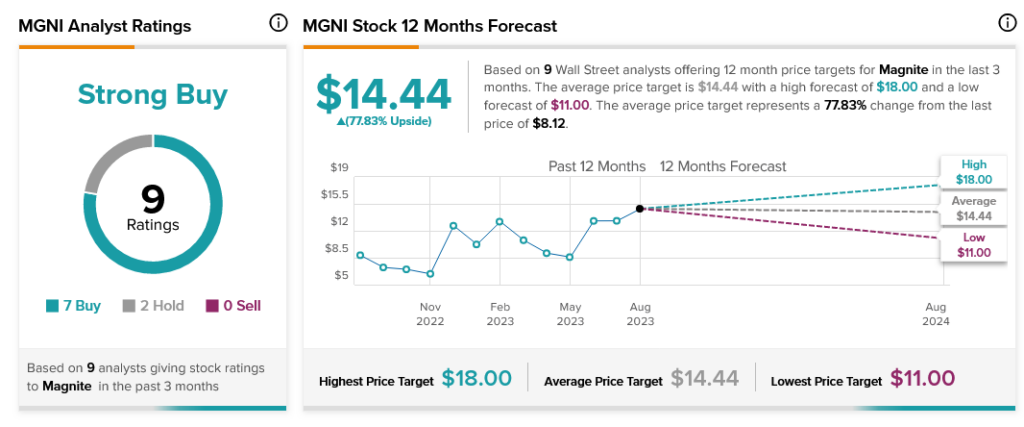

Even as Magnite flounders, though, analysts are still enthusiastically on its side. Magnite stock is currently rated a Strong Buy thanks to seven Buy ratings and two Holds. Meanwhile, Magnite stock offers a 77.83% upside potential thanks to its average price target of $14.44.