Major department store retailer, Macy’s (NYSE:M) gained in pre-market trading after the company reported adjusted diluted earnings of $0.21 per share as compared to adjusted earnings of $0.52 per share in the same period last year. This was above analysts’ expectations that the retailer would just about break even in Q3.

The company’s net sales declined by 7% year-over-year to $5 billion, beating consensus estimates of $4.78 billion. Macy’s comparable sales declined by 7.6% on the basis of its owned stores and fell by 6.7% on an owned-plus-licensed basis.

Moreover, the company raised its FY23 outlook and now expects net sales in the range of $22.9 billion to $23.2 billion as compared to its prior forecast of between $22.8 billion and $23.2 billion. Macy’s expects comparable sales to decline in the range of 7% to 6% year-over-year while adjusted diluted earnings are likely to be between $2.88 and $3.13 per share.

Is Macy’s Stock a Good Buy?

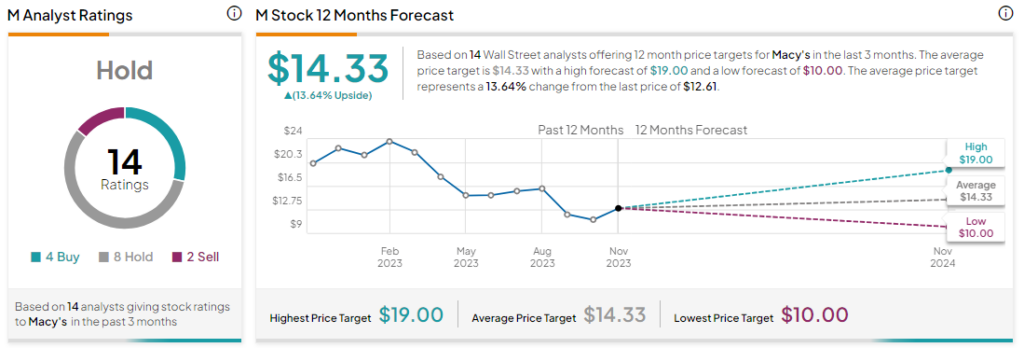

Analysts remain sidelined about Macy’s with a Hold consensus rating based on four Buys, eight Holds, and two Sells. Even with Macy’s stock sliding by more than 30% in the past year, the average Macy’s price target of $14.33 implies an upside potential of 13.6% at current levels.