Department store chain Macy’s (NYSE:M) expects to report Fiscal Q4 sales at the “low-end to mid-point” of its prior guidance of $8.16 million to $8.4 million. The company said that the impact of weak “non-peak holiday weeks” was more severe than anticipated. This is likely due to the persistently high inflation that has been squeezing consumer spending.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Nevertheless, the company witnessed strength in the occasion apparel and gift-giving businesses. Also, its high-end store chain, Bloomingdale’s, and beauty division, Bluemercury, performed well during the quarter.

Regarding future performance, Macy’s expects customers to remain “pressured” this year due to the uncertain macroeconomic environment.

The company expects to release its fourth quarter and Fiscal Year 2022 results in early March 2023. At present, the Street expects Macy’s to report Q4 earnings of $1.61 per share and sales of $8.3 billion.

Is Macy’s a Good Buy?

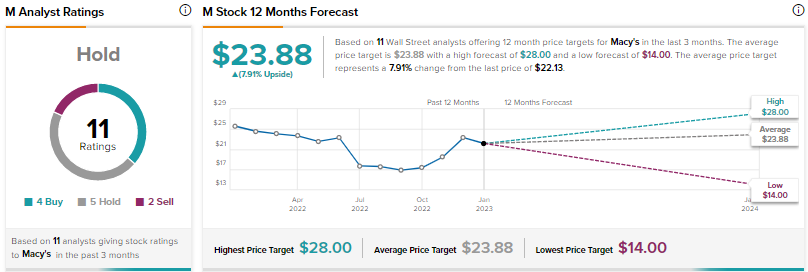

Overall, the stock currently has a Hold consensus rating based on four Buy, five Hold, and two Sell recommendations. Macy’s stock has an average price forecast of $23.88, which implies 7.9% upside potential.