Global semiconductor sales have declined 9.2% year-over-year for the month of November 2022 to $45.5 billion, according to the Semiconductor Industry Association (SIA). Further, compared to October 2022, this was a decline of 2.9%.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Chipmakers continue to face macroeconomic challenges and China’s zero Covid policy had an impact on the figures as well. While 2023 looks set to be as challenging (if not more) as 2022 for the global economy, the World Semiconductor Trade Statistics Organization (WSTS) expects semiconductor sales to contract by 4.1% this year.

The U.S. restrictions on chip exports to China and its steps to boost domestic manufacturing remain key themes playing out in the market over the course of 2023.

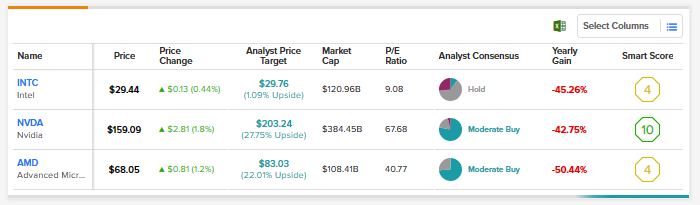

Meanwhile, major names including Intel (INTC), Nvidia (NVDA), and Advanced Micro Devices (AMD) have all declined 45.3%, 42.7%, and 50.4% respectively over the past 52 weeks.

Further, the Direxion Daily Semiconductor 3x Bull Shares ETF (SOXL) has dropped a massive 80% during this period.

Here are some related tickers:

Read full Disclosure