Since my last update on Shopify (SHOP), the narrative has shifted toward the real-world mix of tailwinds and headwinds merchants are feeling at checkout. Oil prices have eased, the dollar has strengthened, parcel costs are climbing into the holidays, and October’s early promo wave has started to pull demand forward.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

On the company side, news flow has been relatively quiet since the ChatGPT-powered checkout reveal. For now, the most honest way to frame SHOP is through its operating levers—costs, currency, and calendar—and how the next round of data could sway sentiment. I remain Bullish on the stock given the potent mix of internal and external factors that provide regular stock catalysts and sustain its ascent.

FX and Freight Dynamics Shape Shopify’s Holiday Shipping Outlook

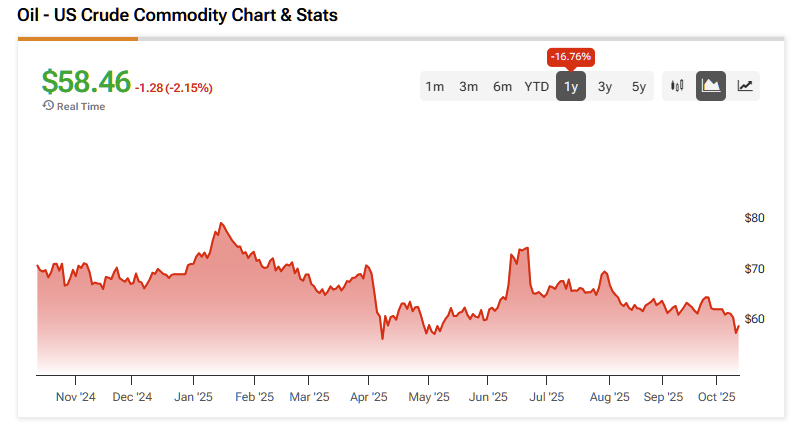

Over the past few days, crude oil has moved in merchants’ favor. Both WTI and Brent variants dipped further, with WTI dipping below $60 per barrel, accelerated by a week of oversupply chatter and tariff jitters. Lower fuel costs tend to trickle into parcel fuel surcharges, leaving consumers a touch less pinched at the pump, which should translate into small, tangible benefits for SHOP as we head into the peak holiday season in the U.S.

The dollar told the opposite story. The U.S. Dollar Index hovered near 99 late in the week—strong enough to dent cross-border conversions for U.S. sellers (as prices appear “higher” to foreign shoppers), yet modestly easing input costs for merchants paying overseas suppliers. In short, FX can dampen international demand even as it helps lower landed costs—a nuance worth remembering when thinking about GMV versus gross margin.

Freight, meanwhile, was boring in the best possible way. Drewry’s World Container Index fell again to roughly $1,651 per 40-foot box, its lowest level since early 2024, providing a stable base for inventory already on the water.

The offset shows up in the last mile. USPS holiday surcharges took effect on October 5 and will run through January 18, with tiered increases across Ground Advantage, Priority Mail, and Parcel Select. UPS (UPS) and FedEx (FDX) are likely to layer in additional peak surcharges through late October and the holidays. For Shopify merchants, this combination points to a season of tighter rate shopping and thinner shipping spreads.

Early Holiday Deals Reshape Shopify’s Q4 Playbook

In the meantime, Amazon’s (AMZN) Prime Big Deal Days (Oct 7–8) effectively kicked off the holiday shopping season, followed closely by Target’s (TGT) Circle Week (Oct 5–11) and Walmart’s (WMT) sale running through Oct 12. These October events, in my view, reset shoppers’ perception of what constitutes a “good deal” and pull demand forward.

For non-Amazon Shopify sellers, the smarter playbook is to focus less on chasing the lowest price and more on targeted segmentation and protecting contribution margins—a strategy that will likely shape Q4 GMV outcomes.

Adobe’s (ADBE) holiday baseline supports that backdrop, projecting U.S. online sales of roughly $253.4 billion for November–December, up 5.3% year over year, with BNPL usage rising and mobile checkouts now the majority. That’s steady, sustainable growth—not a sugar rush—which is fine for Shopify’s take-rate optics, provided discounting remains surgical rather than blanket.

A more measured consumer favors merchants who can personalize the first offer instead of resorting to 20% sitewide discounts. That typically translates into healthier Shop Pay conversions and fewer boomerang returns—both positive signals for Shopify’s platform narrative heading into Q4.

Retail Sales and PPI Set the Stage for Shopify’s Q4 Momentum

With CPI delayed by the government shutdown, the next fundamental swing factors are Thursday’s September Retail Sales and Producer Price Index (PPI) reports.

Retail Sales (8:30 a.m. ET) will show whether consumers carried August’s momentum into the fall, while PPI will test the “costs are easing” thesis suggested by recent declines in oil and ocean freight rates. Then, on October 24, CPI finally lands—just ahead of the late-October Fed meeting—resetting the macro backdrop merchants are budgeting against.

Here are the possible outcomes for Shopify:

- If Retail Sales print firm (including the “control” group), merchants are likely to keep ad budgets open through October, sustaining the demand pulled forward by Prime Big Deal Days and other early holiday events. That would be constructive for Shopify’s GMV cadence into November. A stronger tape could also keep the U.S. dollar bid, modestly pressuring cross-border conversions—but near-term, the GMV tailwind should outweigh that effect.

- If Retail Sales disappoint, expect a pivot toward defensive merchandising—more bundles, free-shipping thresholds, and heavier use of Shop Cash and BNPL to preserve AOV without sacrificing margin. Paradoxically, a softer consumer could prove bullish for long-duration software multiples if it nudges the Fed more dovish later this month; SHOP’s multiple tends to move with that dynamic.

- If PPI cools, it would confirm the freight and energy setup, helping merchants defend gross margins even with active promotions. Conversely, if PPI runs hot, expect carriers and packaging vendors to gain more pricing power heading into November—an unwelcome trend given holiday surcharges already in play.

Thursday’s data should clarify the direction on all fronts.

Is Shopify a Buy, Sell, or Hold?

Wall Street remains relatively bullish on Shopify, with the stock carrying a Moderate Buy consensus rating based on 20 Buy and 14 Hold recommendations over the past three months. Not a single analyst is bearish on SHOP. In the meantime, SHOP’s average stock price target of $166.29 — which is a few cents higher than last week’s — suggests ~8% upside from current levels over the next 12 months.

Macro Catalysts Take the Lead for Shopify Into Year-End

To be fair, there were no major, company-specific bombshells last week for SHOP. Still, plenty of developments mattered for the investment case. Lower oil prices, persistently low container rates, and rising parcel surcharges set the cost backdrop, while a firmer dollar and entrenched October promotions continue to shape demand and pricing behavior.

The next decisive catalysts are macro, with Retail Sales and PPI on October 16, followed by CPI on October 24. I remain constructive into year-end, watching two key dials: (1) margin discipline as carriers layer on holiday fees, and (2) conversion quality as promotional activity widens. If the data point to a resilient consumer and cooperative inflation, Shopify’s GMV glidepath should hold—and the valuation multiple could finally get some breathing room.