Casino stocks are having a good day, specifically those with exposure to the Macau region in China. This can be attributed to a 246.9% year-over-year increase in gross gaming revenue for March, which equates to $1.58 billion. For reference, analysts were expecting an increase of 205%.

Protect Your Portfolio Against Market Uncertainty

- Discover companies with rock-solid fundamentals in TipRanks' Smart Value Newsletter.

- Receive undervalued stocks, resilient to market uncertainty, delivered straight to your inbox.

What’s significant about this result is that it’s the highest monthly gross gaming revenue figure since January 2020. Relaxed travel restrictions following China’s zero-COVID policy definitely helped boost the number of visitors to Macau.

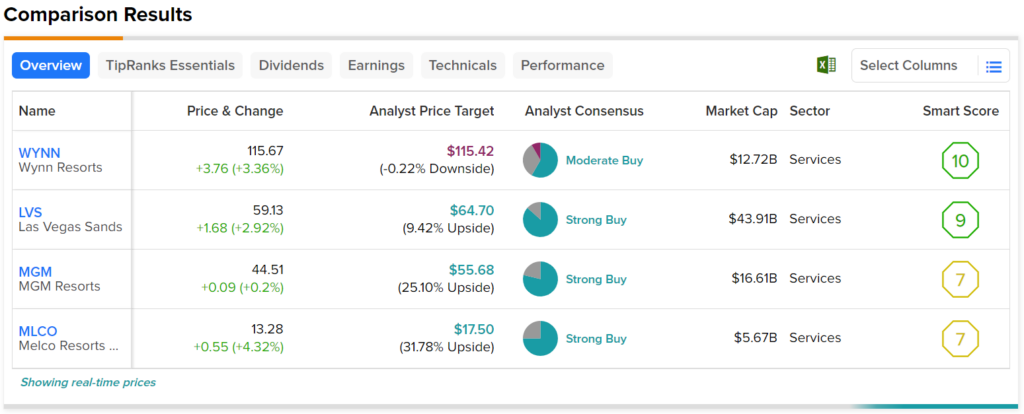

Out of the top Macau stocks — Wynn Resorts (NASDAQ:WYNN), Las Vegas Sands (NYSE:LVS), MGM Resorts (NYSE:MGM), and Melco Resorts (NASDAQ:MLCO) — MLCO stock is up the most in today’s trading session, with a gain of over 4% at the time of writing. Additionally, analysts also expect the most gains from it, with an upside potential of 31.78% based on a price target of $17.50 per share.