Mastercard (NYSE:MA) and Visa (NYSE:V) will announce their quarterly financial numbers on January 26, 2023. While macro headwinds are hard to ignore, consumer spending and cross-border travel have proven resilient, which will likely support the earnings of these leading payment network providers. Let’s dig deeper.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Is Mastercard Buy or Sell?

Mastercard will announce its Q4 (fourth quarter) 2022 financial results on January 26. Its diversified business model and ability to modulate expenses to defend earnings in a tough operating environment position it well to navigate the current macro challenges. Further, the resiliency of consumer spending and the cross-border travel recovery bode well for growth.

Analysts expect Mastercard to post earnings of $2.58 a share in Q4, up 10% year-over-year.

Jefferies analyst Trevor Williams increased his price target on MA stock to $430 from $370 ahead of the Q4 earnings. Williams acknowledged that MA is up against tough year-over-year comparisons. However, the ongoing cross-border recovery and increased exposure to the Asia-Pacific region keep the analyst bullish.

Including Williams, Mastercard stock sports a Strong Buy consensus rating based on 20 Buys and one Hold. Furthermore, analysts’ average price target of $416.30 implies 9.55% upside potential.

What is the Forecast for Visa Stock?

Visa will announce its Q1 financial results on January 26. Ahead of the Q1 print, Wedbush analyst Moshe Katri has named Visa his top pick. Resilient consumer and travel trends keep Katri bullish about Visa’s prospects.

Despite the macroeconomic uncertainty and geopolitical turmoil, Visa delivered strong financial results in Fiscal 2022. Management highlighted strength in consumer payments, resilient e-commerce trends, and recovery in cross-border travel for solid financial numbers. The momentum is likely to sustain itself in Q1 of Fiscal 2023.

Wall Street expects Visa to post earnings of $2.01 per share in Q1 compared to $1.81 in the prior-year quarter.

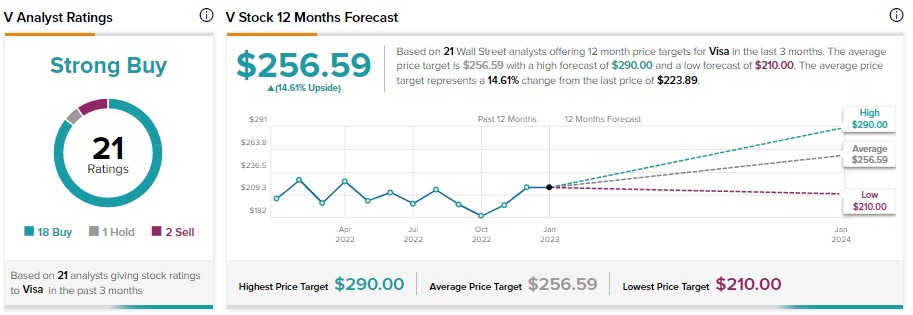

While Visa’s earnings are likely to increase, Wall Street maintains a bullish outlook on the stock. It has a Strong Buy consensus rating, reflecting 18 Buy, one Hold, and two Sell recommendations. Moreover, Visa stock’s price target of $256.59 implies 14.69% upside potential.

Bottom Line

Katri highlighted that the “overall economic environment (employment, consumer spending, and travel) remains resilient despite Fed-induced rate increases and macro slowdown attempts.” The resiliency of consumer spending and favorable travel trends are positives for these payment network providers.

Join our Webinar to learn how TipRanks promotes Wall Street transparency