Data cloud company Snowflake (NYSE:SNOW) is in talks to acquire artificial intelligence (AI) startup Reka AI for more than $1 billion, Bloomberg reported. The move will likely strengthen Snowflake’s generative AI capabilities and help expand its product offerings.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Reka AI specializes in developing large language models (LLMs) that can be applied to various tasks, including image captioning and tagging, content moderation, and engagement (such as customer support and sales).

During the Q4 conference call, Snowflake’s leadership said they expect meaningful investments in AI initiatives to strengthen its offerings. Last month, the company launched Snowflake Arctic, its enterprise-grade LLM. Whether Snowflake announces the acquisition of Reka AI during its upcoming Q1 conference call remains to be seen.

Meanwhile, let’s look at the Street’s forecast for the company’s first quarter.

Snowflake – Q1 Expectations

Snowflake will release its first quarter Fiscal 2025 financial results on Wednesday, May 22. Wall Street expects Snowflake to report revenue of $786.82 million, up 26.2% year over year. This reflects a further moderation in its top-line growth rate on a quarter-over-quarter basis due to the slowdown in product revenue.

It’s worth noting that Snowflake’s product revenue growth rate has decelerated over the past several quarters as enterprise spending remains under pressure amid macro concerns. For example, Snowflake’s product revenue growth was 50% in Q1 of Fiscal 2024. It moderated to 37% in Q2, 34% in Q3, and 33% in Q4, which has weighed on its overall top-line growth.

Meanwhile, analysts expect Snowflake to post earnings of $0.18 per share, up 20% year-over-year. This represents a moderation in its growth rate on a quarter-over-quarter basis. It’s worth noting that Snowflake’s bottom line more than doubled in Q4 of Fiscal 2024.

Is Snowflake a Buy or Sell?

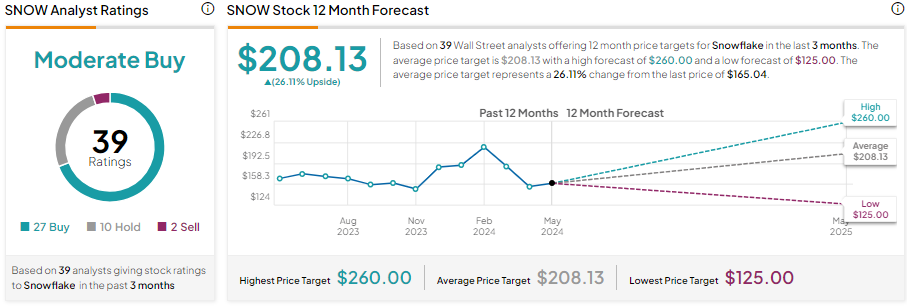

Given the moderation in its growth rate, Snowflake stock is down about 17% year-to-date. Meanwhile, Wall Street is cautiously optimistic about SNOW stock ahead of Q1 earnings. It has a Moderate Buy consensus rating based on 27 Buys, 10 Holds, and two Sell recommendations.

Analysts’ average price target on SNOW stock is $208.13, implying a 26.11% upside potential from current levels.