Oilfield services company SLB (NYSE:SLB) is acquiring a majority stake in pure-play carbon capture company Aker Carbon Capture. The move will likely strengthen its carbon capture business. It will pay 4.12 billion Norwegian Krone (NOK) or $381.5 million to secure an 80% ownership of Aker. Additionally, SLB has committed to making further payments of up to NOK 1.36 billion over the next three years, contingent upon the business’s performance.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

SLB plans to merge its carbon capture operations with Aker, forming a new entity offering industrial decarbonization services on a large scale. The business combination will lower carbon capture costs, thus strengthening SLB’s competitive positioning, attracting new customers, and growing its market share. The transaction will likely close by the end of the second quarter of 2024.

The increase in production and capacity additions in the international and offshore markets has supported SLB’s financials in 2023. Moreover, increased customer spending on digital technologies for planning and operational efficiencies drove sales in its Digital & Integration segment. Thanks to its strong financial performance, SLB reduced net debt by $1.4 billion in 2023 and paid $2 billion to its shareholders through dividends and stock repurchases.

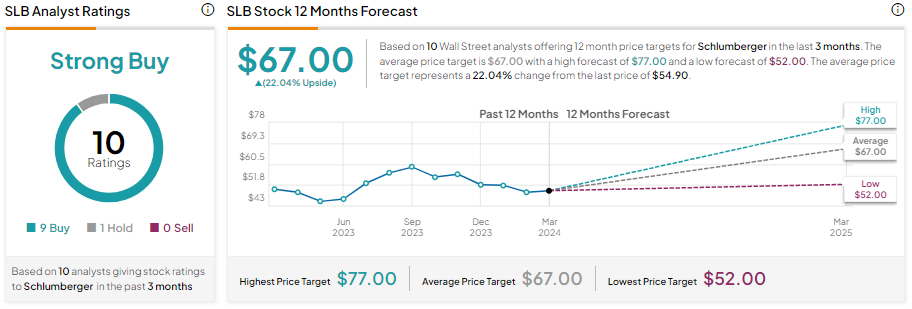

What is the prediction for SLB Stock?

Schlumberger, which rebranded its business as SLB, has seen its stock rise by 17.6% in one year. Wall Street analysts are bullish about SLB’s prospects. With nine Buy and one Hold ratings, the stock has a Strong Buy consensus rating. Analysts’ average SLB stock price target of $67 implies 22.04% upside potential.