AI firm OpenAI (PC:OPAIQ) announced on Thursday that it has acquired Software Applications Incorporated, which is a small startup that created an AI interface for Apple (AAPL) computers. The company’s product, called Sky, allows Mac users to interact with their computers using natural language in order to help with tasks like writing, coding, planning, and daily management. Sky can also take actions within apps and understand what’s on the user’s screen. Furthermore, all 12 employees from Software Applications will join OpenAI, though the financial terms of the deal were not shared.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Interestingly, Nick Turley, who is the head of ChatGPT at OpenAI, said that Sky’s integration with Mac systems helps move OpenAI closer to its goal of embedding AI directly into everyday tools. In addition, according to the company’s website, OpenAI CEO Sam Altman participated in Software Applications’ $6.5 million seed funding round. The purchase of Software Applications is part of a trend for OpenAI, which has made several acquisitions recently.

In September, the company acquired product development startup Statsig for $1.1 billion, and earlier in May, it purchased AI hardware firm io for over $6 billion. The acquisition of Software Applications was led by Turley and Fidji Simo, OpenAI’s CEO of applications, which suggests that the company continues to focus on building AI-powered tools that integrate more deeply into users’ daily workflows.

Is Apple a Buy or Sell Right Now?

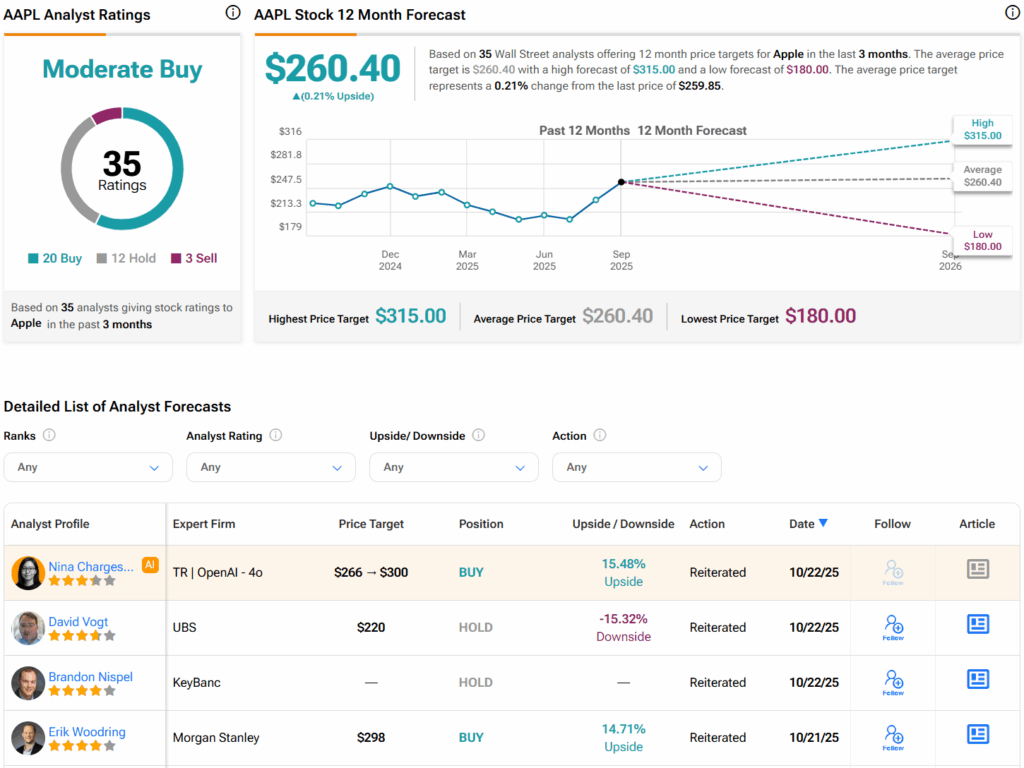

Turning to Wall Street, analysts have a Moderate Buy consensus rating on AAPL stock based on 20 Buys, 12 Holds, and three Sells assigned in the past three months, as indicated by the graphic below. Furthermore, the average AAPL price target of $260.40 per share implies that shares are trading near fair value.