Occidental Petroleum (NYSE:OXY) is discussing the potential acquisition of Permian oil producer CrownRock, as per The Wall Street Journal’s report. The deal is expected to be worth over $10 billion, including debt. The buyout would considerably enhance Occidental’s foothold in the Permian Basin, as CrownRock holds over 80,000 net acres in the prime Midland Basin region of Texas.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

It is worth mentioning that CrownRock is one of the last remaining big private companies in the region. It is run by Texas billionaire Timothy Dunn and backed by the private equity firm Lime Rock Partners.

Consolidation Wave

The oil and gas industry is undergoing a period of consolidation, with several major acquisition announcements made recently. The strong cash position of these companies, buoyed by soaring oil prices in the post-pandemic era, supports their expansion strategies.

Among the major deals revealed last month, Exxon Mobil (XOM) acquired Pioneer Natural (PXD) for $59.5 billion to create America’s largest shale producer in the Permian Basin.

Furthermore, in late October, Chevron (CVX) disclosed plans to buy Hess Corp. (HES) in an all-stock deal worth $53 billion. The buyout gives CVX access to HES’ promising assets located in Guyana and the Bakken Shale.

Is OXY a Buy Right Now?

Warren Buffett-backed Occidental’s strategic expansion in the Permian and Rockies, coupled with favorable oil prices, is poised to strengthen the company’s financial performance. Additionally, OXY’s commitment to low-carbon initiatives, such as direct air capture, positions it well for long-term growth.

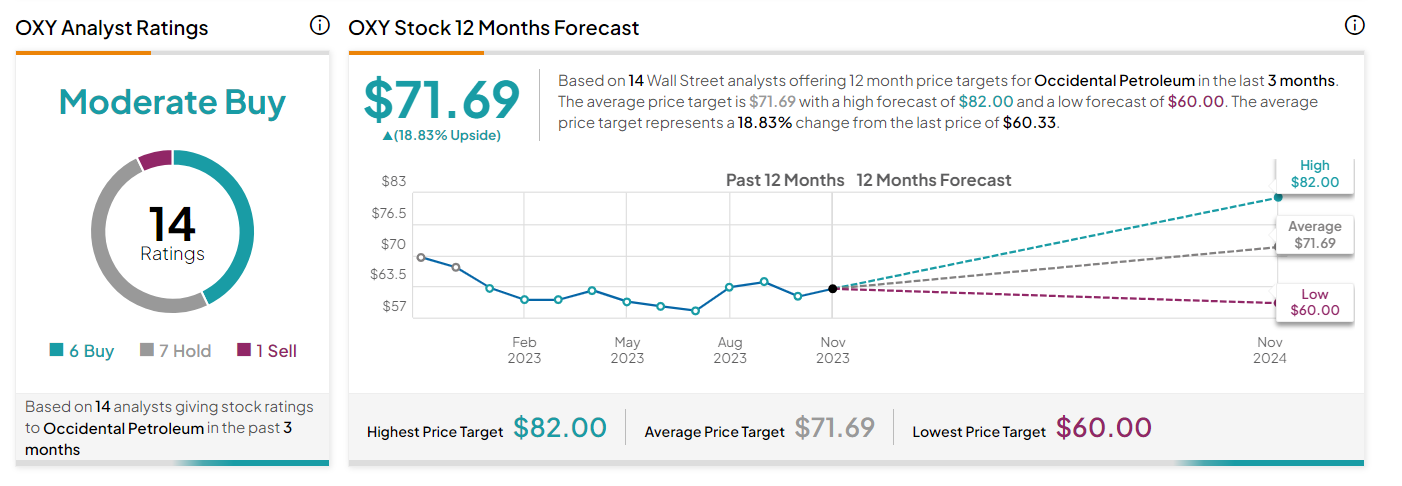

Wall Street analysts are cautiously optimistic about Occidental. It has a Moderate Buy consensus rating based on six Buys, seven Holds, and one Sell. The average stock price target of $71.69 implies 18.8% upside potential.