LVMH Moët Hennessy Louis Vuitton, or LVMH (FR:MC) (LVMUY), is reportedly broadening its media footprint with the purchase of Challenges, one of France’s leading political and economic magazines. The deal shifts ownership from longtime publisher Claude Perdriel after nearly 40 years. Notably, Perdriel currently owns a 60% stake in Challenges, while LVMH holds 40% and is aiming for full ownership through this deal.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

LVMH is a European fashion house known for its iconic luxury brands like Dior, Louis Vuitton, Sephora, Fendi, Bulgari, and more.

LVMH Expands Into French Media

According to AFP, Perdriel, the longtime majority shareholder of Challenges, has agreed to sell the influential economic and political weekly to LVMH. However, LVMH has not officially confirmed the deal.

Perdriel has run the magazine for decades, but he’s almost 99 and is stepping away. LVMH’s acquisition of Challenges provides the magazine with greater financial backing and resources. Additionally, the deal strengthens LVMH’s diversification strategy, making it a major player in French media by adding economic, political, and cultural news to its core fashion and luxury business.

However, some people worry that a big luxury company owning a news magazine might make it harder for the journalists to stay completely independent when reporting on issues that could affect LVMH’s business.

Notably, LVMH already owns the media group Les Echos–Le Parisien, which includes both newspapers and Radio Classique. Earlier this year, it expanded its press holdings by buying the liberal daily L’Opinion and the financial site L’Agefi, where it previously held partial stakes.

Is LVMH Stock a Good Buy?

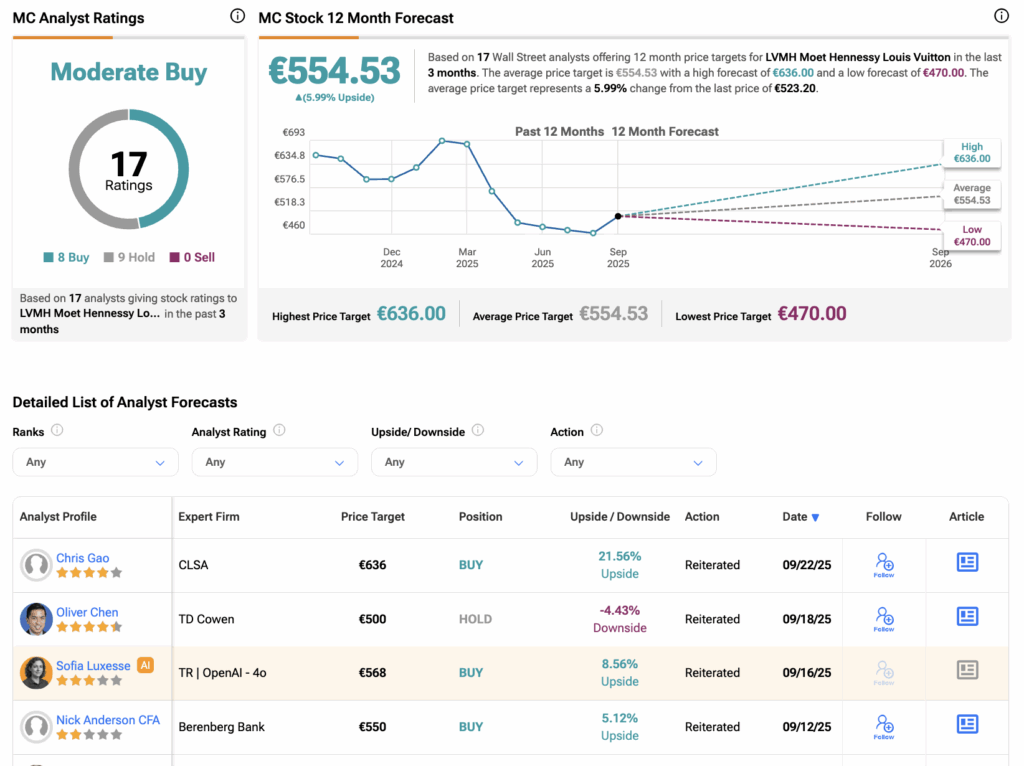

Overall, MC stock has received a Moderate Buy rating on TipRanks, backed by a total of 17 recommendations from analysts. It includes eight Buys and nine Holds assigned in the last three months. The LVMH share price target is €554.53, which is 6% higher than the current trading level.