Tech giant IBM (IBM) announced that it’s acquiring Cognitus, which is a top provider of SAP (SAP) S/4HANA services with industry-focused, AI-powered solutions. IBM says that this deal will improve its ability to support digital transformation by combining services, software, and deep industry knowledge. Indeed, Cognitus will bring valuable SAP expertise to IBM, along with a strong software portfolio.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The company is also recognized as an SAP Gold and Co-Innovation partner for its tailored solutions that help businesses manage data and drive growth. Its key software tools include CIS-GovCon for government contracts, CLM for AI-powered contract management, a low-code data migration tool, and Real-Time Billing for handling large volumes of transactions quickly. These tools are designed to help clients make faster decisions, stay compliant, and run operations more smoothly.

Notably, Cognitus leaders stated that the deal creates more opportunities for their team and allows them to serve a wider range of global customers with IBM’s support. As a result, both companies agree that the partnership will help speed up SAP transformations through AI and innovation. However, the financial details of the deal weren’t shared, and it’s still subject to regulatory approvals.

Is IBM a Buy, Sell, or Hold?

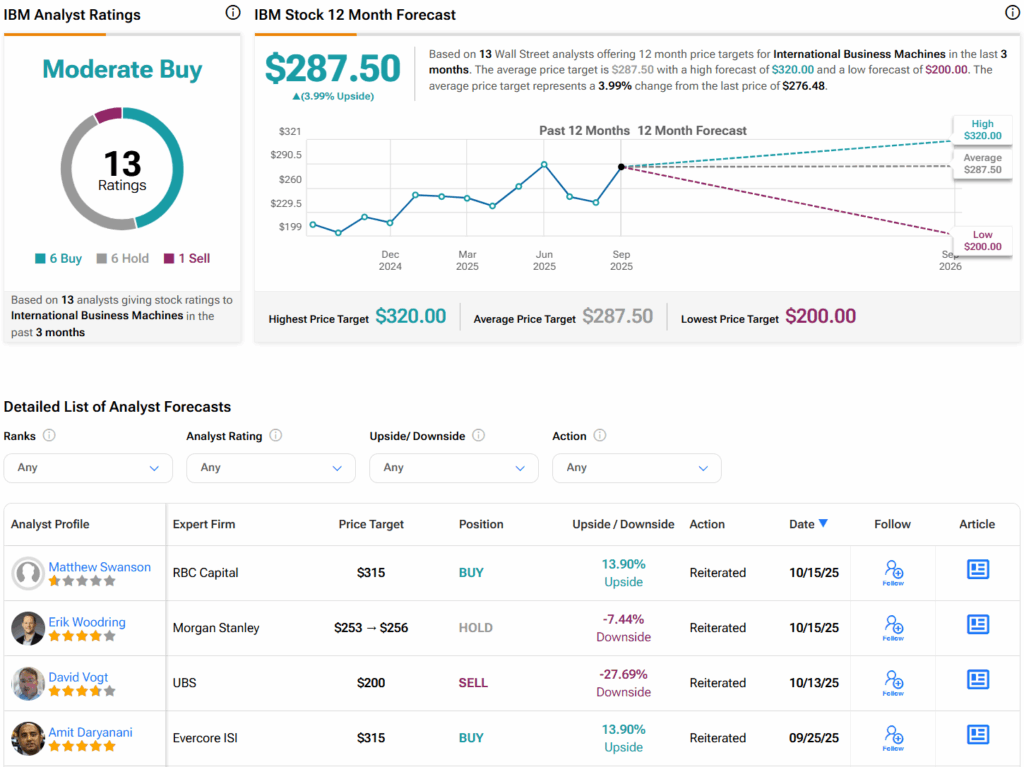

Turning to Wall Street, analysts have a Moderate Buy consensus rating on IBM stock based on six Buys, six Holds, and one Sell assigned in the past three months, as indicated by the graphic below. Furthermore, the average IBM price target of $287.50 per share implies that shares are trading near fair value.