Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Nordstrom (NYSE:JWN) shares finished 4.4% higher after reports suggested that the founding family might consider a new buyout bid. According to a recent Wall Street Journal article, CEO Erik Nordstrom and President Pete Nordstrom informed the board of their interest in potentially taking the company private.

This wouldn’t be the first time the family has considered such a move. In fact, its previous attempt to buy out the company was turned down when it proposed $50 per share back in 2018.

Whether or not the company ends up being acquired, it’s probably a good sign for investors that the family is remaining committed to the company. Indeed, insiders seem to have a lot of confidence since they control over 43% of shares. This can be further confirmed by Nordstrom’s 4.07% dividend yield, which means that management isn’t concerned about its ability to remain profitable.

Is Nordstrom a Good Stock to Buy Now?

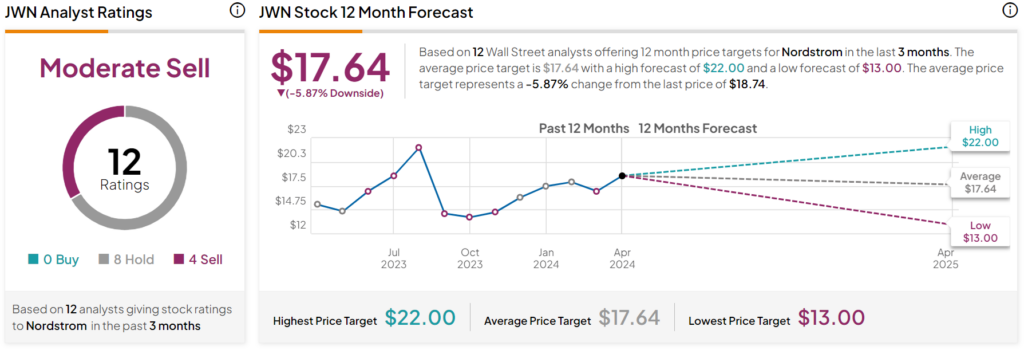

Turning to Wall Street, analysts have a Moderate Sell consensus rating on Nordstrom stock based on eight Holds and four Sells assigned in the past three months, as indicated by the graphic below. After a 15% rally in its share price over the past year, the average JWN price target of $17.64 per share implies 5.87% downside risk.

Is JWN the Right Stock to Buy for Passive Income?

Before you hurry to invest in JWN, think about the following:

TipRanks’ team has built a Smart Dividend Stock Portfolio for investors, and Nordstrom is not included. Our portfolio highlights companies that have been hand-picked for their potential to deliver significant passive income for years to come.