Sports betting platform DraftKings (DKNG) is buying Railbird, which is a predictions platform licensed by the Commodity Futures Trading Commission, as it gets ready to launch a new mobile app called DraftKings Predictions. The goal of the deal is to bring in Railbird’s technology and team to support this next growth phase. CEO Jason Robins told CNBC that prediction markets could be a big new opportunity, and combining Railbird’s platform with DraftKings’ brand and mobile experience could help the company succeed in this space.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

For context, prediction markets let users trade on the outcomes of events in areas like finance, entertainment, and culture. This would allow DraftKings to move beyond just sports betting. However, markets tied to elections and sports are more controversial. In fact, many states, along with their gaming regulators and tribal groups, are suing or taking steps to stop companies from offering these kinds of trades by arguing that betting on sports outcomes amounts to unlicensed gambling.

To avoid legal issues, DraftKings is expected to focus its sports-related event trading only in states that don’t already allow legal sports betting, like California and Texas. The company can also use technology to block access on tribal lands. And since DraftKings already operates in the regulated gambling space, it may add stronger identity checks—known as “know your customer” guardrails—to make sure that users are properly verified and meet legal requirements.

Is DKNG Stock a Good Buy?

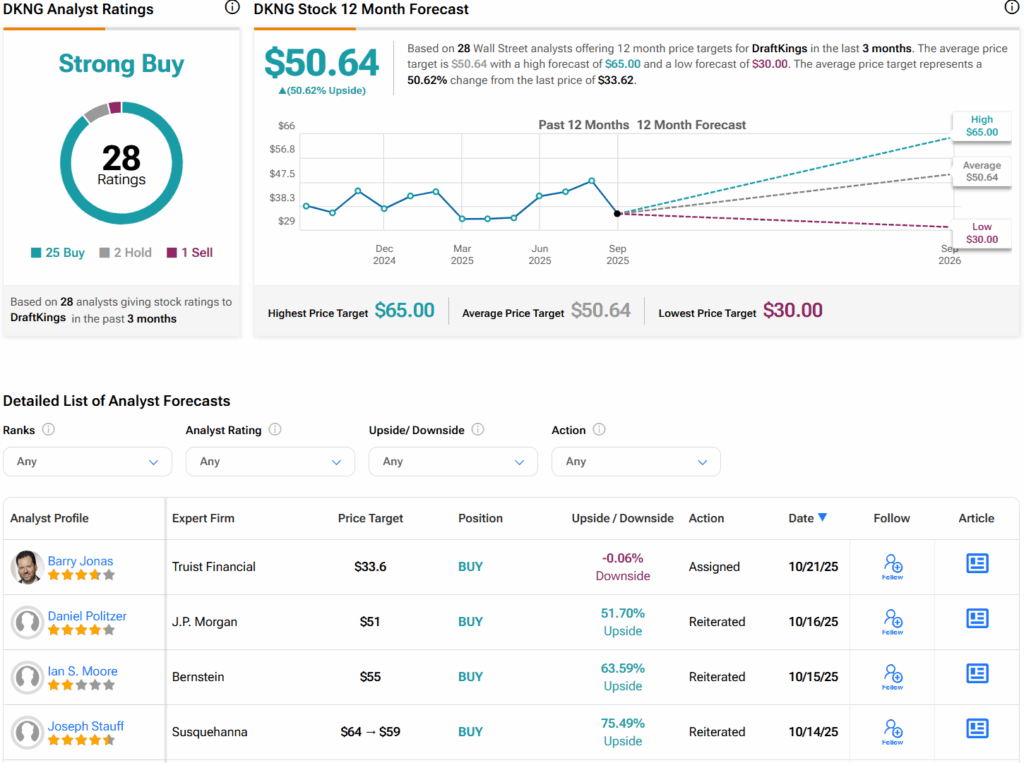

Turning to Wall Street, analysts have a Strong Buy consensus rating on DKNG stock based on 25 Buys, two Holds, and one Sell assigned in the past three months, as indicated by the graphic below. Furthermore, the average DKNG price target of $50.64 per share implies 50.6% upside potential.