Following weeks of speculation, Walt Disney (NYSE:DIS) and Reliance Industries are close to entering into a non-binding pact to merge their Indian media operations. According to Bloomberg, the cash-and-stock deal could materialize as early as next week.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Reportedly, Reliance will pour funds to acquire at least a 51% stake in the combined entity. This M&A transaction could potentially create one of the largest media names in the Indian market. Further, the diligence and valuation process will begin once the pact is signed.

However, the exact amount of the funds to be infused by Reliance is yet to be determined. Previously, Disney pegged the valuation for the India unit at nearly $10 billion. In comparison, Reliance was said to be considering the assets at around $7 billion to $8 billion.

Disney’s India unit has been experiencing dwindling subscriber numbers. The Indian market remains fiercely competitive, with multiple streaming giants in the race to gain market share. Mukesh Ambani-led Reliance Industries has gradually strengthened its presence in this space with streaming rights to the Indian Premier League and multi-year broadcasting deals.

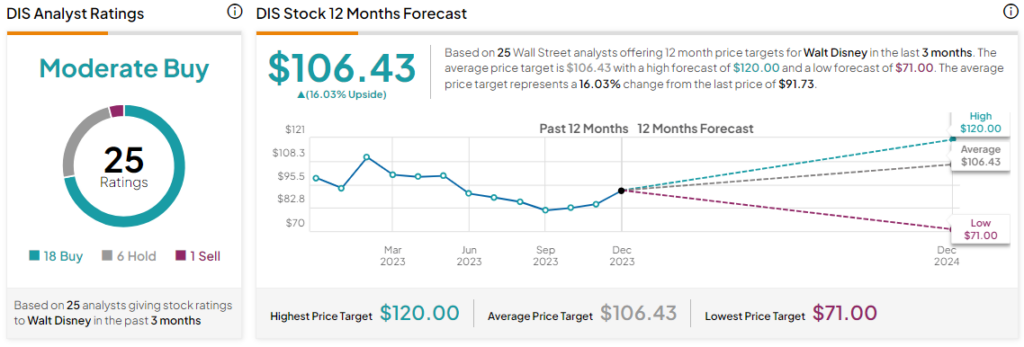

What is the Target Price for DIS Stock?

Overall, the Street has a Moderate Buy consensus rating on Disney. Following a nearly 4.5% gain in the company’s share price over the past month, the average DIS price target of $106.43 implies a further 16% potential upside in the stock.

Read full Disclosure