U.S.-based Comcast’s (CMCSA) Sky is reportedly in advanced talks to acquire the media and entertainment division of British broadcaster ITV (GB:ITV) in a deal valued at around $2.15 billion, including debt. Following the reports, ITV shares in London jumped over 15% as of this writing, while CMCSA stock is up by 0.037% in pre-market hours in the U.S.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

For context, Comcast is a media and tech giant behind NBCUniversal and Sky, and is best known for its cable, broadband, and entertainment businesses. ITV, meanwhile, is a UK broadcaster with popular TV shows and streaming services. Its ad-driven Media & Entertainment division includes its free-to-air channels and ITVX platform. The potential deal would not include ITV Studios.

What This Deal Means for Comcast

The potential sale, first reported by Bloomberg, remains at an early stage. Later on, ITV described the talks as “preliminary” in its statement.

For Sky, the deal would represent a major move in Europe’s media landscape, expanding its content library and strengthening Comcast’s footprint in the UK entertainment sector. It would make Sky the UK’s largest commercial broadcaster.

Additionally, Comcast sees an opportunity to combine Sky’s pay-TV service with ITV’s free-to-air channels, creating a stronger UK streaming platform capable of competing with U.S. giants like Netflix (NFLX), Amazon (AMZN), and Disney (DIS).

What the Sky Deal Could Mean for ITV’s Future

For ITV, a potential sale of its M&E division could help unlock value at a time when its core ad-driven business is under strain. Offloading the unit would allow ITV to focus more on its production arm, ITV Studios, which has been performing better and offers steadier, global revenue streams compared to the volatile advertising market.

Notably, ITV Studios’ strong performance has prompted analysts to suggest that the production arm may be worth more than the company’s entire broadcasting business, which includes some of the UK’s most-watched channels.

At the same time, ITV’s M&E division relies heavily on advertising and has been pressured by a sluggish ad market. Yesterday, ITV announced its Q3 2025 results and warned of a sharp decline in advertising revenue as companies scale back marketing budgets amid concerns over potential tax hikes in the upcoming budget. The company expects total advertising revenue to fall 9% in the final quarter of 2025, pulling full-year sales down by around 6%.

Is CMCSA a Good Stock to Buy?

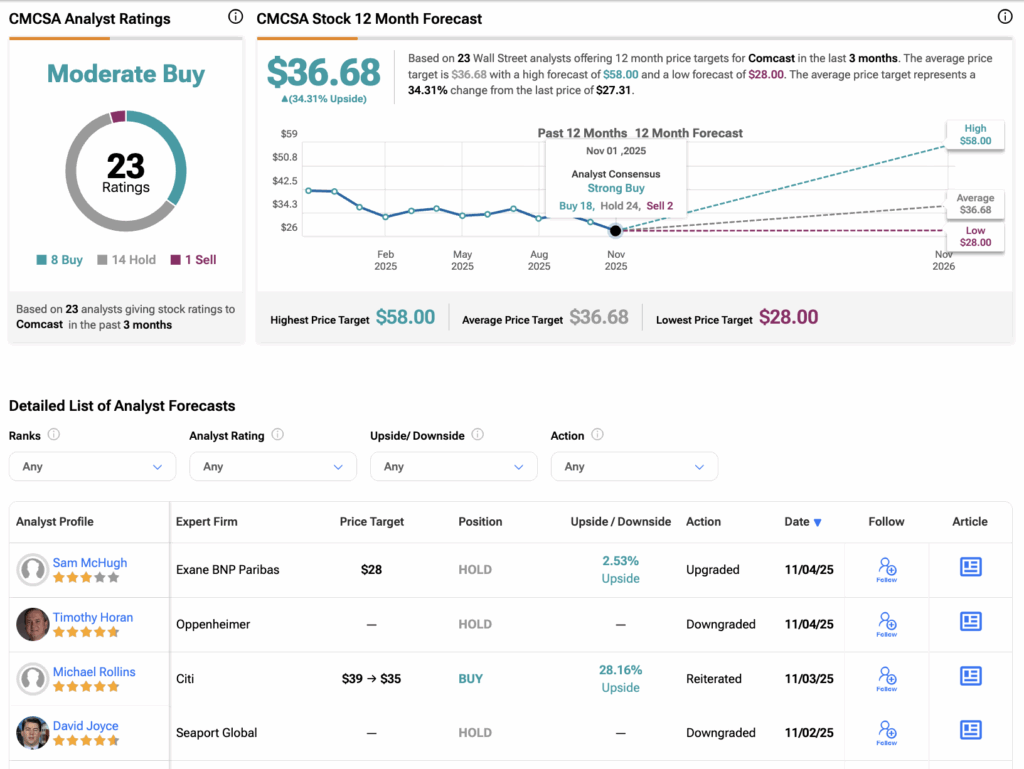

Turning to Wall Street, CMCSA stock has received a Moderate Buy based on eight Buys, 14 Holds, and one Sell assigned in the last three months. Moreover, the average Comcast stock price target of $36.68 implies a 34.3% upside potential from current levels.