After much market chatter, Choice Hotels (NYSE:CHH) has commenced a hostile bid for Wyndham Hotels & Resorts (NYSE:WH).

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

This development comes after Choice’s earlier efforts to acquire Wyndham fell on deaf ears. Choice already has a stake worth over $110 million in Wyndham. Now, its exchange offer will be aimed directly at Wyndham’s shareholders.

The exchange offer remains unchanged at $49.50 in cash and 0.324 Choice shares for every Wyndham share. The proposal equates to a 14.9x multiple for Wyndham’s estimated adjusted EBITDA for 2023. Further, Choice is offering a regulatory ticking fee of $0.45 per Wyndham share per month to benefit Wyndham’s investors if the transaction takes longer than 12 months to close.

Choice is also offering Wyndham two seats on the combined entity’s Board, and the exchange offer stands until March 8, 2024. In the meantime, Choice plans to nominate a slate of directors to Wyndham’s Board at the latter’s 2024 annual meeting.

While Wyndham has indicated that the combined entity could end up with too much debt, Choice feels joining forces could help them fare better against larger peers. In the meantime, Patrick Pacious, the CEO and President of Choice, is still willing to negotiate with Wyndham about the strategic M & A move. Pacious noted, “It remains our goal to reach a mutually agreeable transaction, and there is potential for additional value to be unlocked if Wyndham were to return to the negotiating table and provide due diligence.”

What is the Price Target for CHH?

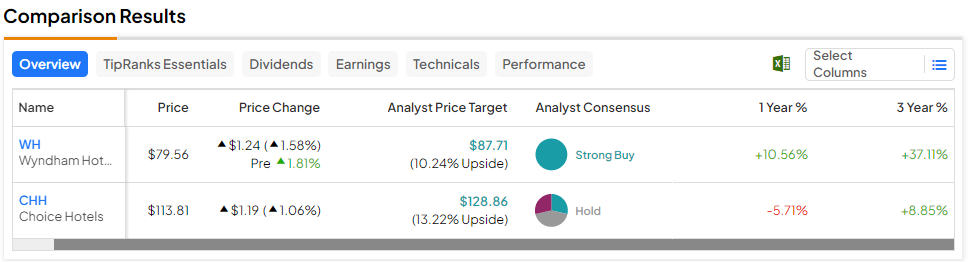

The TipRanks Comparison Tool indicates that Choice shares have failed to deliver substantial price appreciation for investors over the past three years. On the other hand, Wyndham has rallied nearly 37% during this period. Still, the Street sees a higher upside potential of 13.2% in Choice stock, based on a Moderate Buy consensus rating and an average CHH price target of $128.86.

Read full Disclosure