U.S.-based AT&T (T) has agreed to buy Lumen Technologies’ (LUMN) consumer fiber business for $5.75 billion in cash, powering up its nationwide fiber network. Following the announcement, T stock gained 0.18% in after-hours trading, while LUMN soared almost 12%.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The deal covers last-mile fiber assets, associated network components, and customer relationships, which will be managed by a newly formed AT&T subsidiary, NetworkCo. As part of the agreement, some Lumen employees are expected to join either AT&T or NetworkCo. Notably, the deal excludes Lumen’s enterprise fiber clients and its Mass Markets copper-based customers.

AT&T Doubles Down on Fiber

According to AT&T’s statement, the acquisition will bring an additional 1 million fiber customers for the company. It will also broaden its fiber network across key metro areas, including Denver, Las Vegas, Minneapolis-St Paul, Orlando, Phoenix, Portland, Salt Lake City, and Seattle. Over time, these customers will transition to AT&T Fiber, gaining access to straightforward pricing, multi-gig speeds, built-in security, and reliable coverage.

Meanwhile, AT&T doesn’t anticipate a significant impact on its EBITDA or free cash flow within 12 to 24 months of closing the deal. However, the acquisition is expected to be beneficial over the long term, and AT&T has reaffirmed its full-year 2025 financial guidance.

For Lumen, the sale enables a sharper focus on its enterprise fiber business. Moreover, the proceeds will also support investments in low-latency technology essential for AI-driven applications. The cash will also allow Lumen to reduce its debt by $4.8 billion and boost cash flow by cutting over $300 million in annual interest costs.

The transaction is anticipated to close in the first half of 2026, subject to regulatory approvals. Lumen will provide transitional support to AT&T for around two years after the transaction closes.

Is AT&T a Good Stock to Buy in 2025?

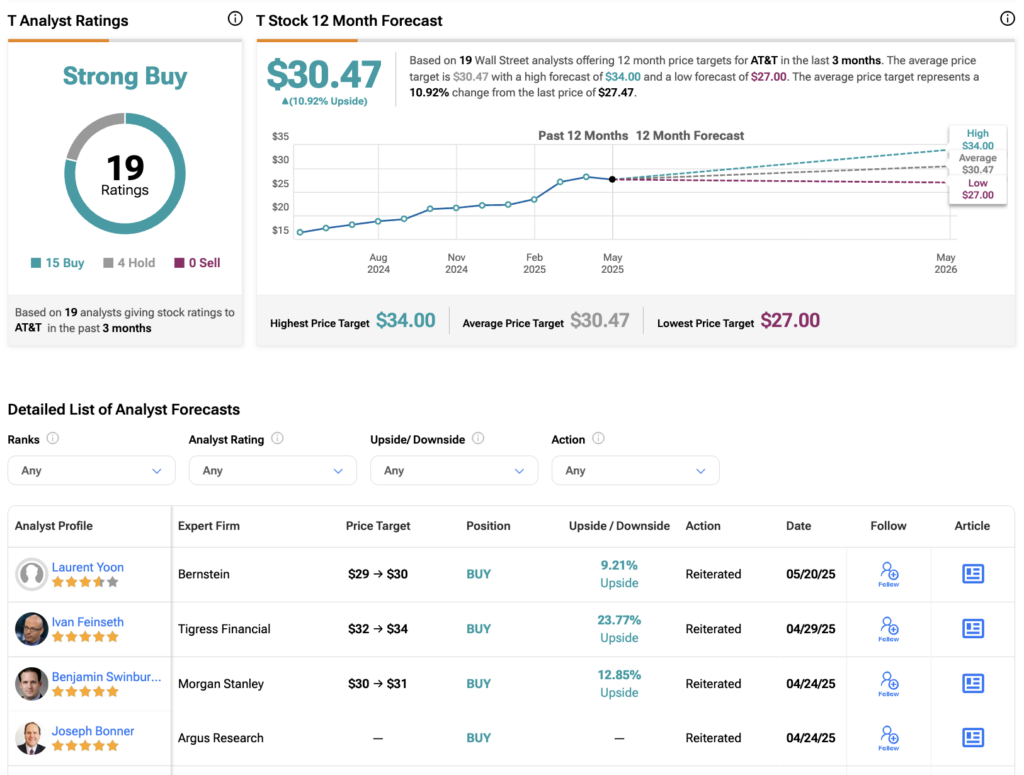

Overall, Wall Street has a Strong Buy rating on T stock, based on 15 Buys, four Holds assigned in the last three months. The average AT&T share price target is $30.47, which implies an 11% upside from the current levels.