AES Corp. (AES) stock is drawing investor attention after reports surfaced that BlackRock’s (BLK) Global Infrastructure Partners is reportedly nearing a $38 billion deal to acquire the utility giant. According to the Financial Times, people familiar with the matter said GIP could announce the AES acquisition within days, though the talks are still ongoing and could change. Following the news, AES German-listed shares (DE:AES) have gained almost 15% as of this writing on Wednesday.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

AES is a global power company that generates and distributes electricity, with a growing focus on renewable energy and sustainable solutions. Meanwhile, BlackRock’s GIP is an infrastructure investment platform with holdings in airports, energy, and transport networks worldwide.

How the $38B AES Acquisition Impacts Both Sides

AES has invested significantly in renewable energy grids, which are critical to powering the data centers of Microsoft (MSFT), Meta (META), and Alphabet (GOOGL). However, its shares have dropped almost 35% over the past year as investors turned cautious, partly due to its renewable energy focus and the rollback of green energy tax credits under President Trump.

If completed, the takeover would rank among the biggest infrastructure deals ever, potentially reshaping AES’s path and drawing renewed investor attention.

On the other hand, the surge in power needs driven by AI has prompted major infrastructure funds to invest heavily in data center capacity. For GIP, acquiring AES offers a strategic opportunity to tap into the growing renewable energy sector and benefit from the energy transition, particularly as demand from tech companies’ data centers rises.

Additionally, GIP’s strong track record in utilities and large infrastructure projects, including its $6.2 billion Allete (ALE) acquisition, makes AES a natural and complementary fit.

Is AES a Buy, Sell, or Hold?

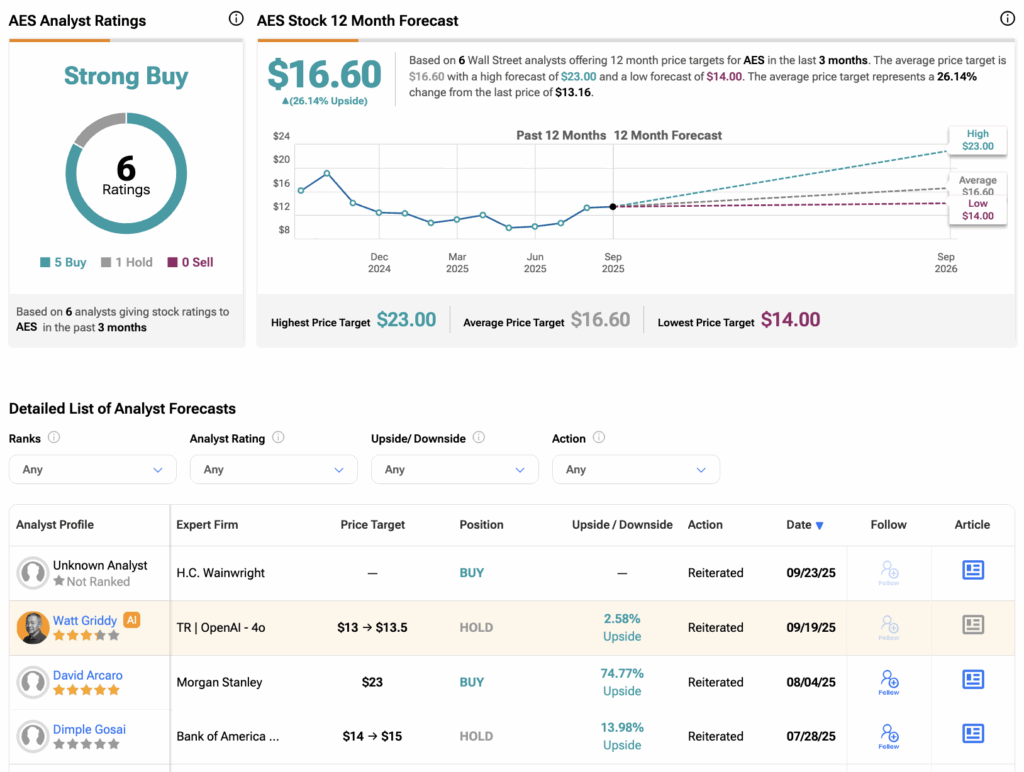

Turning to Wall Street, analysts have a Strong Buy consensus rating on AES stock based on 21 Buys, seven Holds, and two Sells assigned in the past three months. The AES stock price target of $16.60 per share implies a 26.14% upside potential.