Biotechnology company ImmunoGen (NASDAQ:IMGN) skyrocketed in pre-market trading after another biotech company, AbbVie (NYSE:ABBV), announced that it would acquire IMGN for $31.26 per share in cash. This equates to a total equity value of around $10.1 billion. AbbVie will also acquire ImmunoGen’s “flagship cancer therapy Elahere (mirvetuximab soravtansine-gynx), a first-in-class antibody-drug conjugate (ADC) approved for platinum-resistant ovarian cancer (PROC).”

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

AbbVie stated that both companies’ boards of directors had approved the transaction. The acquisition is expected to be completed in the middle of next year. The company expects IMGN’s oncology portfolio to boost its revenue over the long term. ELAHERE, a targeted medicine offering significant survival benefits in ovarian cancer, presents a multi-billion-dollar opportunity for AbbVie with expansion possibilities in various therapy lines and market segments.

Is ABBV Stock a Buy or Sell?

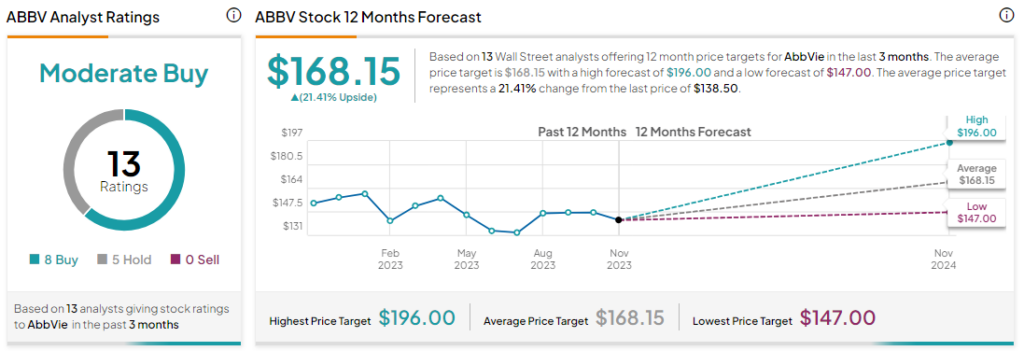

Analysts remain cautiously optimistic about ABBV stock, with a Moderate Buy consensus rating based on eight Buys and five Holds. Year-to-date, ABBV stock has slid by more than 10%. As a result, the average ABBV price target of $168.15 implies an upside potential of 21.4% at current levels.