Macy’s (NYSE:M) shares are ticking lower today after the omni-channel retailer announced its fourth-quarter results and a major strategy shift. In Q4, the company’s revenue decreased by 1.7% year-over-year to $8.12 billion. Still, the figure came in ahead of expectations by $50 million. In tandem, EPS of $2.45 outperformed estimates by $0.47.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

While brick-and-mortar sales remained largely flat during the quarter, the company’s digital sales declined by 4%. Further, comparable sales contracted by 5.4%. Macy’s is experiencing strength in its beauty and backstage off-price categories. However, weakness persists in women’s shoes, cold weather apparel, and accessories. Despite these pressures, the company’s gross margin improved by 340 basis points to 37.5% due to fewer clearance markdowns and improving supply chain dynamics.

For Fiscal Year 2024, Macy’s expects net sales of $22.2 billion to $22.9 billion. Adjusted EPS for the year is estimated in the range of $2.45 to $2.85. Additionally, the company expects comparable sales growth to be between -1.5% and 1.5%.

The firm aims to reposition itself with a new business strategy, dubbed A Bold New Chapter. Under this strategy, Macy’s plans to shutter nearly 150 stores while prioritizing investments in 350 locations. The company also plans to open up to 45 new Bloomingdale’s and Bluemercury locations.

It also plans to streamline and monetize its supply chain portfolio. These actions will lead to low-single-digit comparable sales growth starting from 2025 and annual adjusted EBITDA growth in the mid-single-digit range. As a result of these moves, Macy’s took a $1 billion impairment charge in Q4.

Importantly, these actions from Macy’s come in the wake of Arkhouse Management’s attempts to take over the company. Earlier this month, Arkhouse made nine nominations to Macy’s Board at its upcoming annual meeting. Last month, Macy’s rejected a $5.8 billion acquisition offer from Arkhouse and Brigade Capital Management.

Is M Stock a Good Buy?

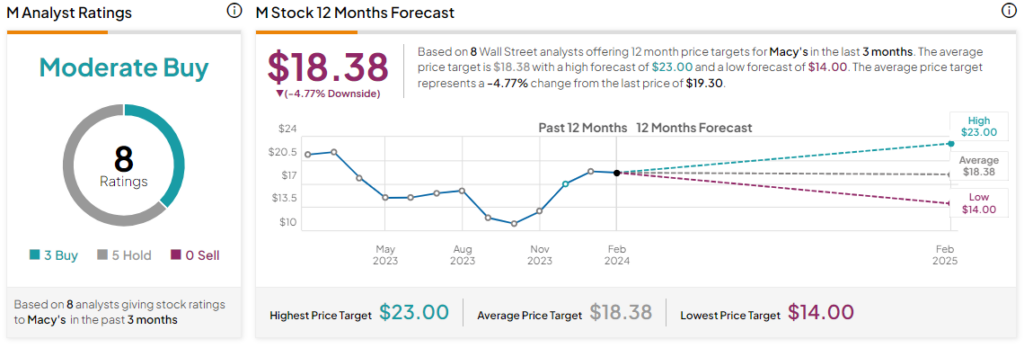

Macy’s stock price has jumped by nearly 62% over the past six months. Overall, the Street has a Moderate Buy consensus rating on Macy’s, and the average M price target of $18.38 implies a potential downside of 4.8% in the stock. However, analysts’ views on the stock could see changes following today’s earnings report.

Read full Disclosure