Global payments technology company Visa (NYSE:V) has agreed to acquire a controlling stake in Prosa, a top-tier payments processing company in Mexico. Visa did not disclose the specific financial details of the agreement. However, the transaction is expected to be finalized in the latter half of 2024.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Visa has announced that Prosa will maintain its autonomy as an independent company, retaining its distinct technology infrastructure. Additionally, Visa plans to enhance Prosa’s range of products by introducing new digital solutions. Notably, the current shareholders of Prosa, including HSBC Mexico, Invex, Banorte, Scotiabank Mexico, Santander Mexico, and Banjército, will retain ownership of the remaining stake in the company.

Visa’s Acquisition Game Is Fueling Growth

Visa consistently explores opportunities to enhance its capabilities and increase shareholder value through mergers and acquisitions. The company leverages acquisitions, joint ventures, and strategic investments to deliver value-added services and accelerate growth.

In Fiscal year 2023, the company announced the acquisition of Pismo, a cloud-based platform for cards and core banking.

As with the Prosa deal, Visa will likely gain a foothold in Mexico’s growing digital payments market. Prosa has over five decades of experience in payment processing in Mexico, with a solid customer base. Moreover, it processes more than 10 billion transactions per year.

With this backdrop, let’s look at the Street’s forecast for Visa stock.

What is the Forecast for Visa Stock?

Visa is benefitting from resilient consumer spending. Further, a recovery in cross-border travel spending is a positive. This is reflected in analysts’ optimistic outlook on its stock.

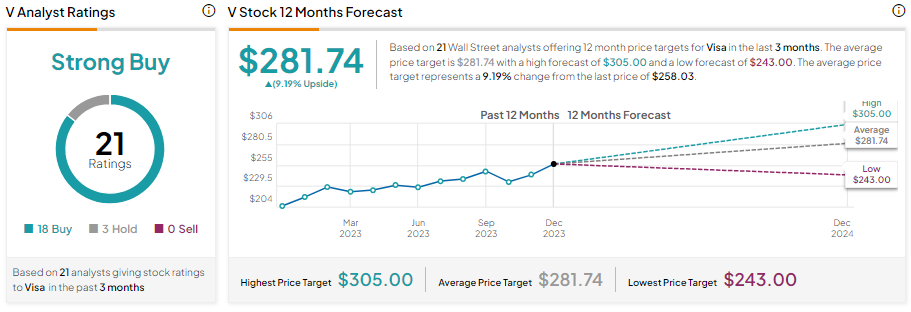

With 18 Buy and three Hold recommendations, Visa stock has a Strong Buy consensus rating. Further, analysts’ average Visa price target of $281.74 implies 9.19% upside potential from current levels.