According to multiple reports, Japan’s entertainment powerhouse Sony Group (NYSE:SONY) has called off the $10 billion merger of its India unit with the country’s Zee Entertainment Enterprises Ltd. (ZEEL).

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Reportedly, Sony has called it quits after the conditions for the M & A deal remained unfulfilled. The termination closes the curtains on the nearly two-year acquisition drama between the two companies. This, in turn, leaves ZEEL in a weak spot at a time when its competitors are clocking rapid market gains.

Notably, the deal was derailed over whether ZEEL CEO Punit Goenka, who is facing an investigation by Indian financial regulators, could lead the merged entity. According to MoneyControl, Goenka’s potential ouster from ZEEL could bring Sony back to the negotiating table. Goenka and his father – the founder of ZEEL, have been accused of abusing their position and siphoning off funds by India’s SEBI (the Securities and Exchange Board of India).

The derailed deal not only leaves ZEE vulnerable but could also force Sony to chalk up a new strategy for the Indian market. Competitors such as Reliance’s Jio, Netflix (NASDAQ:NFLX), and Amazon (NASDAQ:AMZN) have continued to carve out steady gains in the lucrative Indian market, where a large population has easy access to cheap data to binge on hours and hours of online content.

In the meantime, ZEEL is considering taking legal action against Sony, according to LiveMint.

Is SONY a Good Stock to Buy Right Now?

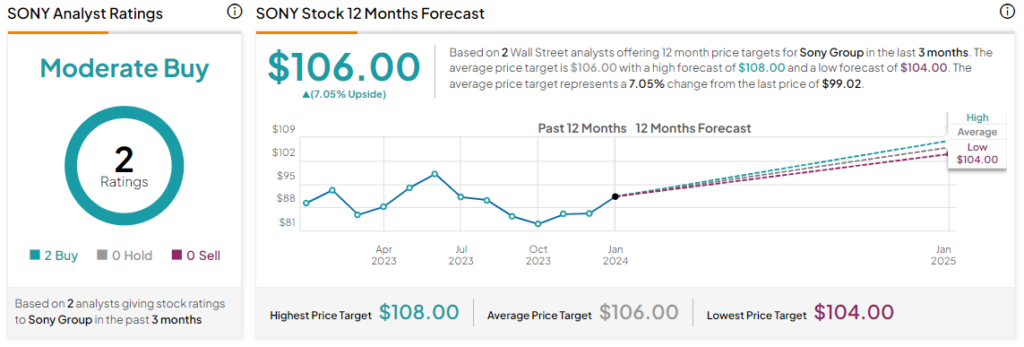

Overall, the Street has a Moderate Buy consensus rating on Sony Group. Following a nearly 8% rise in the company’s share price over the past month, the average SONY price target of $106 implies a modest 7% potential upside in the stock.

Read full Disclosure