Cloud-based data platform provider Snowflake (NYSE:SNOW) announced the acquisition of Samooha, a tech startup that develops a secure data collaboration platform utilizing data clean rooms. The financial terms of the deal were not disclosed.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

A data clean room is a secure environment that enables multiple companies to aggregate data for collaborative analysis. It is noteworthy that data clean rooms are becoming increasingly popular as they empower businesses to securely share sensitive first-party data with external partners or customers. Also, it allows enterprises to adhere to stringent governance requirements related to security and privacy.

Let’s dig deeper.

Samooha to Strengthen Snowflake’s Data Offerings

Snowflake highlighted that the adoption of data clean rooms has been rapid within the media and entertainment sectors due to the evolving technological landscape and regulatory privacy framework. The company now expects a rise in demand for data clean rooms across various industries, particularly in sectors with high regulations such as financial services and healthcare, where secure collaboration on highly sensitive data is paramount.

The acquisition of Samooha will likely enhance Snowflake’s privacy-preserving technology, solidifying its data offerings. The deal is expected to position Snowflake as a leading player in this space, facilitating secure data collaboration across diverse industries and driving its financials. Moreover, in a similar move, Snowflake announced the acquisition of LeapYear, a data privacy platform, earlier in February.

With Snowflake taking measures to capitalize on the rising demand for secure data sharing and collaboration, let’s look at what the Street recommends for Snowflake stock.

What is the Prediction for Snowflake Stock?

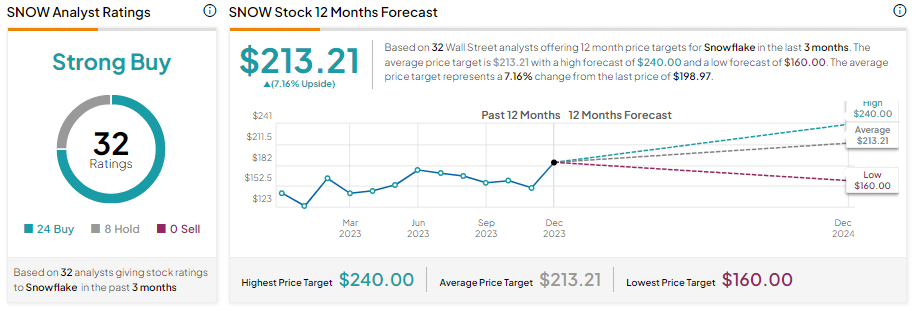

Wall Street analysts are upbeat about Snowflake’s prospects. With 24 Buy and eight Hold recommendations, SNOW stock has a Strong Buy consensus rating. Further, the analysts’ average price target of $213.21 implies 7.16% upside potential from current levels.