Rumors are swirling that Chinese fashion powerhouses Shein and Temu (NASDAQ:PDD) might be eyeing a deal with home goods retailer Wayfair (NYSE:W). Wayfair has been struggling with a dwindling customer base, which has led to a severe 82% drop in stock value over the past three years. Reports from The Information suggest that both Shein and Temu, known for their budget-friendly offerings, are exploring ways to improve their market positions and take on e-commerce titan Amazon (NASDAQ:AMZN).

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The Information views Shein as the more likely candidate for Wayfair, pointing out that Shein could greatly benefit from Wayfair’s well-established U.S. warehouse and distribution network. Yet, the prospect of a merger is complicated by the tense U.S.-China political landscape. Indeed, the increasing scrutiny over Chinese investments in American businesses potentially makes any such deal challenging.

Is Wayfair Stock a Good Buy?

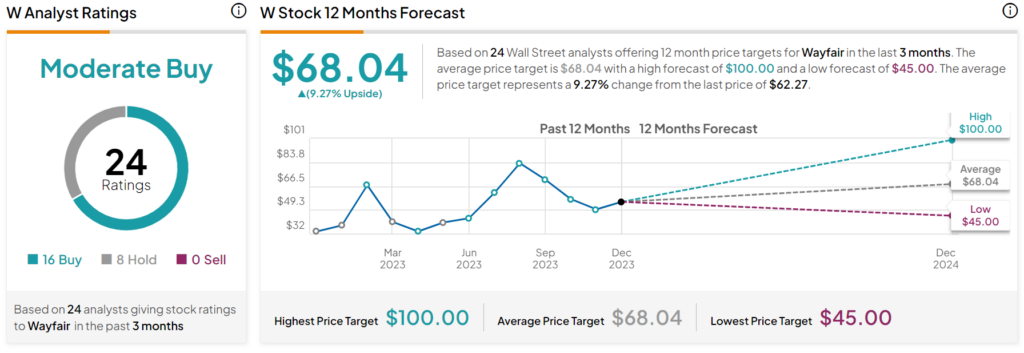

Turning to Wall Street, analysts have a Moderate Buy consensus rating on Wayfair stock based on 16 Buys, eight Holds, and zero Sells assigned in the past three months, as indicated by the graphic below. After a 95% rally in its share price over the past year, the average W price target of $68.04 per share implies 9.27% upside potential.