Endeavor Energy Partners is exploring a sale amidst consolidation in the energy sector, a Reuters report highlighted. It is a leading privately held oil and gas company in the Permian Basin, which makes it a lucrative acquisition target.

While Exxon Mobil (NYSE:XOM) has not expressed interest in acquiring Endeavor thus far, its solid balance sheet and large scale suggest that it is well-positioned to acquire and integrate the company. It is worth highlighting that Exxon recently announced the acquisition of Pioneer Natural Resources. The deal will likely bolster Exxon’s presence in the oil-rich Permian Basin. What stood out is that the $59.5 billion transaction is an all-stock deal, which means that XOM still has ample financial resources to acquire more companies.

Exxon ended the third quarter with a debt-to-capital ratio of 17% and a cash balance of $33 billion. This suggests that it could easily acquire Endeavor, which is seeking a valuation between $25 billion and $30 billion. It remains to be seen whether XOM plans to pursue Endeavor’s acquisition, but its addition could significantly enhance Exxon’s standing in the region.

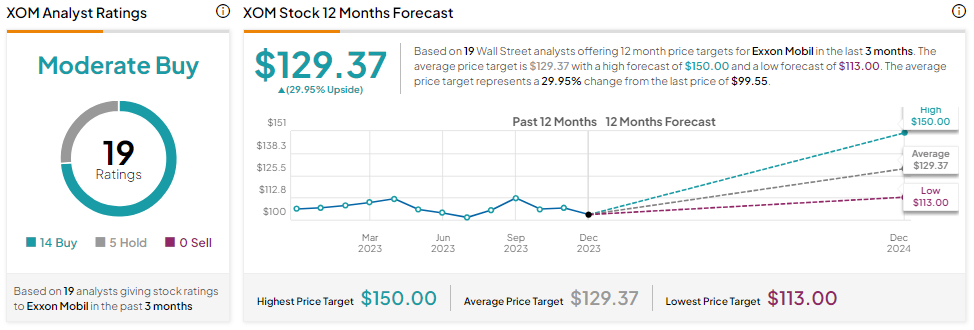

Meanwhile, let’s look at the Street’s forecast for Exxon stock.

Is Exxon Stock Expected to Rise?

Exxon Mobil’s focus on structural cost savings will likely drive its earnings and cash flows, enabling the company to pursue growth opportunities and return cash to its shareholders. However, lower average price realizations keep analysts cautiously optimistic about XOM stock.

With 14 Buys and five Holds, Exxon stock has a Moderate Buy consensus rating. Meanwhile, analysts’ average price target of $129.37 shows an upside potential of 29.95% over the next 12 months.