American Tower Corporation (NYSE:AMT) has concluded its strategic review of its Indian operations (ATC India) and will offload it for $2.5 billion. The Real Estate Investment Trust (REIT), which focuses on communications infrastructure, has disclosed that Data Infrastructure Trust, an Infrastructure Investment Trust supported by an affiliate of Brookfield Asset Management (NYSE:BAM)(TSE:BAM), will acquire all equity interests in ATC India.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The company expects to close the deal in the second half of 2024. Moreover, AMT plans to utilize the transaction’s proceeds to repay its existing debt.

Under the agreement, American Tower will retain the full economic benefits associated with the optionally converted debentures (OCDs) issued by Vodafone Idea. Furthermore, it has affirmed eligibility to receive upcoming payments tied to existing ATC India receivables.

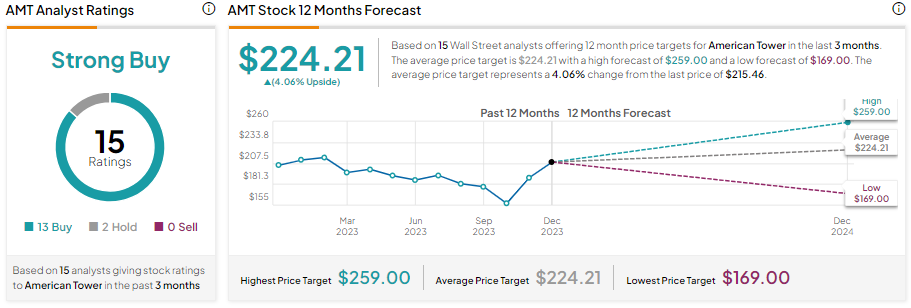

Is American Tower a Buy, Sell, or Hold?

American Tower stock has shown recovery and is up over 38% in three months.

Further, with its leading tower portfolio, extensive real estate footprint, and data center ecosystem, American Tower remains well positioned to benefit from the increased investments in communications infrastructure like towers, data centers, and distributed edge infrastructure.

AMT stock has received 13 Buys and two Holds for a Strong Buy consensus rating. However, analysts’ average price target of $224.21 implies a limited upside potential of 4.1% from current levels.