Shares of American Electric Power (NASDAQ:AEP) are trending higher today after the integrated utility company agreed to sell its 50% interest in New Mexico Renewable Development (NMRD) to Exus North America Holdings.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Together, AEP and PNM Resources plan to sell 15 solar projects to Exus for about $230 million. PNM also owns a 50% interest in NMRD. AEP expects to realize ~$104 million, net of fees and taxes, from the deal.

The M & A transaction is anticipated to close in February 2024. Importantly, this deal is part of AEP’s push to simplify its operations and focus investments on its core business. Earlier this year, the company sold parts of its contracted renewables business for $1.5 billion. The proceeds from these deals are expected to fortify the company’s balance sheet.

Last month, AEP reaffirmed its operating earnings outlook of between $5.24 and $5.34 per share for 2023. This figure is expected to hover between $5.53 and $5.73 per share for 2024. Further, the company projects a long-term growth rate of 6% to 7%.

Is AEP a Good Stock to Buy?

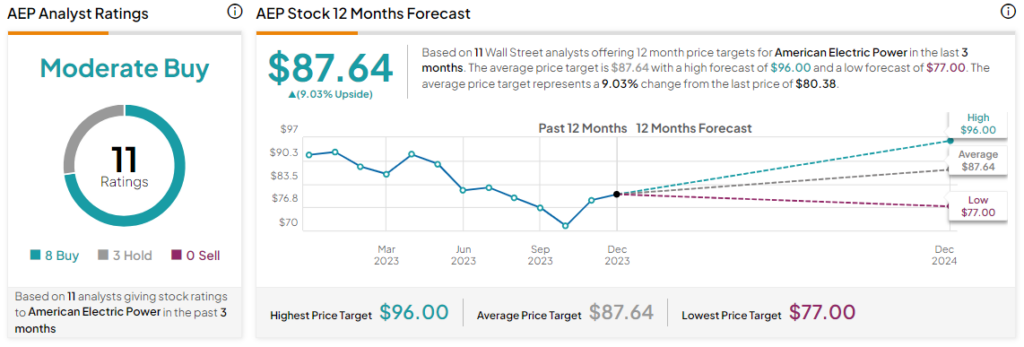

Overall, the Street has a Moderate Buy consensus rating on American Electric Power, and the average AEP price target of $87.64 points to a modest 9% potential upside in the stock. That comes after a nearly 15% decline in the company’s share price over the past year.

Read full Disclosure