Ride-hailing company Lyft (LYFT) has partnered with Amazon (AMZN) and Anthropic, an AI startup backed by Alphabet (GOOGL), to introduce artificial intelligence tools to its customer care operations. The company is using Anthropic’s Claude AI model through Amazon’s Bedrock generative AI platform to improve its customer service. This technology has already shown promising results by reducing the average customer service resolution time by 87%.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

However, the use of AI for customer service has raised concerns about job loss in the industry. Nevertheless, Lyft emphasized that human customer support agents will still be necessary. Indeed, the company plans to use AI to resolve simple customer issues and then escalate more complex problems to human agents, such as safety, deactivations, and fraud. AI is being seen as an opportunity to improve operations, not reduce headcount, according to Jason Vogrinec, executive vice president at Lyft.

In addition, the partnership between Lyft and Anthropic will enable future collaborations on tools to benefit both riders and drivers. Anthropic will also train Lyft’s engineers on the technology. It is worth noting that Lyft is set to report its quarterly results on February 11, which may provide more insight into the company’s plans for AI-powered customer service.

Is Lyft a Good Stock to Buy?

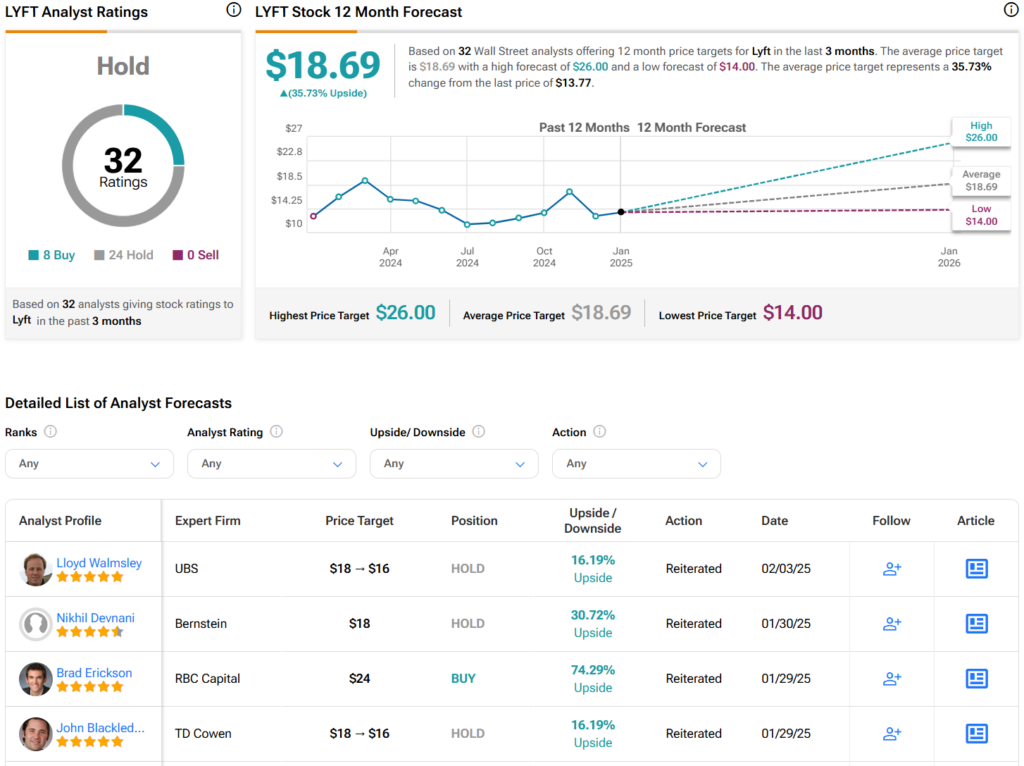

Turning to Wall Street, analysts have a Hold consensus rating on LYFT stock based on eight Buys, 24 Holds, and zero Sells assigned in the past three months, as indicated by the graphic below. After an 11% rally in its share price over the past year, the average LYFT price target of $18.69 per share implies 35.7% upside potential.