Shares of Lyft (NASDAQ:LYFT) plunged more than 15% in yesterday’s extended trade despite better-than-expected first-quarter results. The fall can be attributed to the ridesharing service provider’s weak forecast for the second quarter of 2023.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Revenue of $1 billion increased 14% year-over-year and surpassed the consensus estimates of $987.7 million. Lyft’s Q1 adjusted loss of $0.07 per share came above the analysts’ expectations of a loss of $0.10 per share.

On the other hand, active riders registered 9.8% growth year-over-year to 19.6 million. Further, revenue per rider jumped 4% to $51.17 in the reported quarter. Lyft also reported adjusted EBITDA (earnings before interest, tax, depreciation, and amortization) of $22.7 million, which exceeded its own expected range of $5 to $15 million.

Regarding Q2 guidance, Lyft predicted revenues between $1 billion and $1.02 billion, while the consensus is pegged slightly higher at $1.08 billion. Additionally, adjusted EBITDA is projected between $20 million and $30 million, while analysts estimate the number at $51 million.

Is Lyft a Good Stock to Buy?

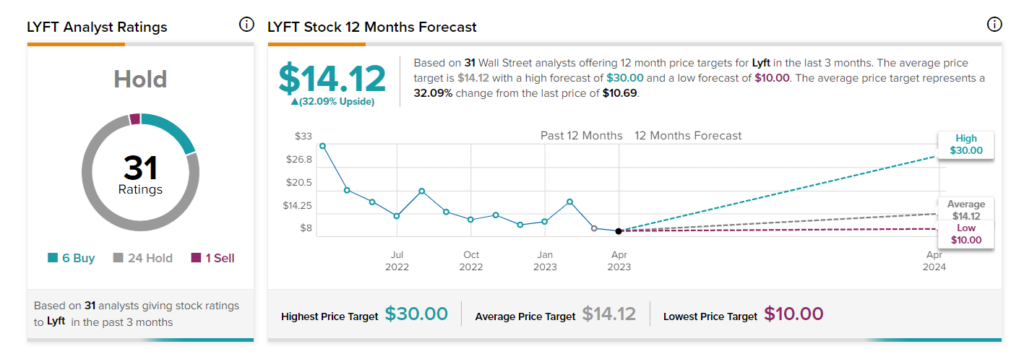

On TipRanks, analysts have a Hold consensus rating on Lyft stock based on six Buys, 24 Holds, and one Sell rating. The average stock price forecast is $14.12, which implies a 32.1% upside potential to current levels.