Lamb Weston (LW) stock was up on Tuesday after the potato goods manufacturer posted its Fiscal Q1 2026 earnings report. That report started with adjusted earnings per share of 74 cents, compared to Wall Street’s estimate of 54 cents. This represented a 5% decrease year-over-year.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Lamb Weston reported revenue of $1.66 billion during its latest quarter, which beat analysts’ estimate of $1.62 billion. It also marked a less than 1% rise year-over-year compared to $1.65 billion. The company attributed this to “solid volume growth and positive customer momentum,” which it said underscores “the strength of our value proposition and our operating model.”

Lamb Weston stock was up 8.33% in pre-market trading on Tuesday, following a 0.81% rally yesterday. The shares have decreased 15.05% year-to-date and 14.24% over the past 12 months.

Lamb Weston Guidance

Lamb Weston reaffirmed its Fiscal 2026 guidance in its latest earnings report. The company continues to expect revenue to range from $6.35 billion to $6.55 billion, adjusted EBITDA between $1 billion and $1.2 billion, and cash used for capital expenditures of approximately $500 million.

Lamb Weston noted that its current guidance takes into account the impact of enacted tariffs by the U.S. and other governments. However, it doesn’t cover “potential effects of evolving trade policies, including future changes in tariffs or retaliatory measures.”

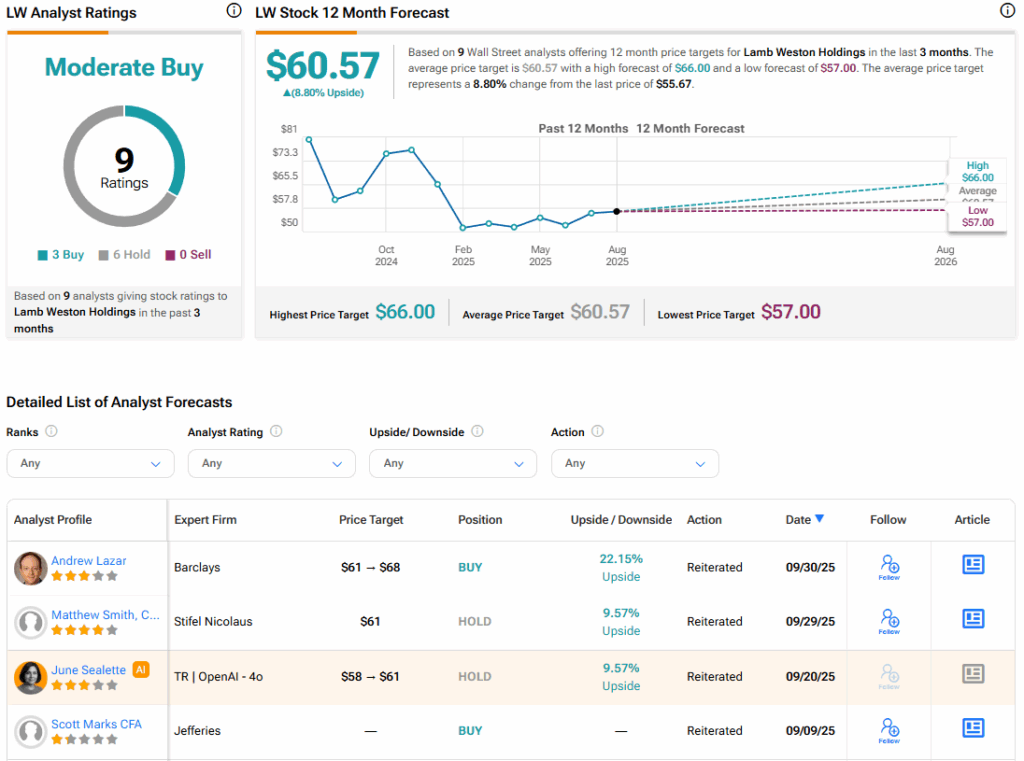

Is Lamb Weston Stock a Buy, Sell, or Hold?

Turning to Wall Street, the analysts’ consensus rating for Lamb Weston is Moderate Buy, based on three Buy and six Hold ratings over the past three months. With that comes an average LW stock price target of $60.57, representing a potential 8.8% upside for the shares. These ratings and price targets will likely change as analysts update their coverage after today’s earnings report.