A while back, we heard that airlines and hotels were likely to more aggressively focus on the luxury traveler. This notion eliminated a lot of lower- and middle-class travelers, but it also opened up a market that is extremely resilient. This meant opportunity for Delta Air Lines (DAL), who recently reported impressive earnings despite a market that looks increasingly unsteady overall. But shareholders were less convinced. Shares of Delta were down over 2% in Wednesday morning’s trading.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The numbers from Delta were good enough on their own, featuring revenue of $15.2 billion and $1.71 per share in earnings. Delta also managed to keep its costs steady and even clear some of its debt load, making it stronger overall. In fact, reports note, premium cabins and business travelers now account for about 60% of Delta’s revenue. Given that that market segment was less than half before the pandemic, the end result suggests that the upscale traveler is always in play.

The numbers present a clear picture, albeit a disturbing one. High earners are still booking rooms and upgrading seats, while the mid- to lower-tier earners are pulling back and circling the wagons against a potential disaster ahead. Thus, while many discretionary markets are suffering right now, those targeting high-earners are still holding up well.

New Rules on Delta

Meanwhile, those flying Delta—whether upscale or otherwise—may want to be aware of new rules when flying with the airline. The Transportation Security Administration (TSA) has made several changes. While you no longer need to take off your shoes before flying, you do need to have a Real ID. Those without one will be routed to separate lines for further questioning. Portable chargers with lithium-ion batteries are also out of the picture for checked luggage, but still okay for carry-ons.

Look also for changes in premium seat pricing thanks to improved experiences—as we covered previously—and also, consider joining Delta SkyMiles if for no other reason than access to the Wi-Fi, which is reportedly quite good.

Is Delta Stock a Buy or Sell?

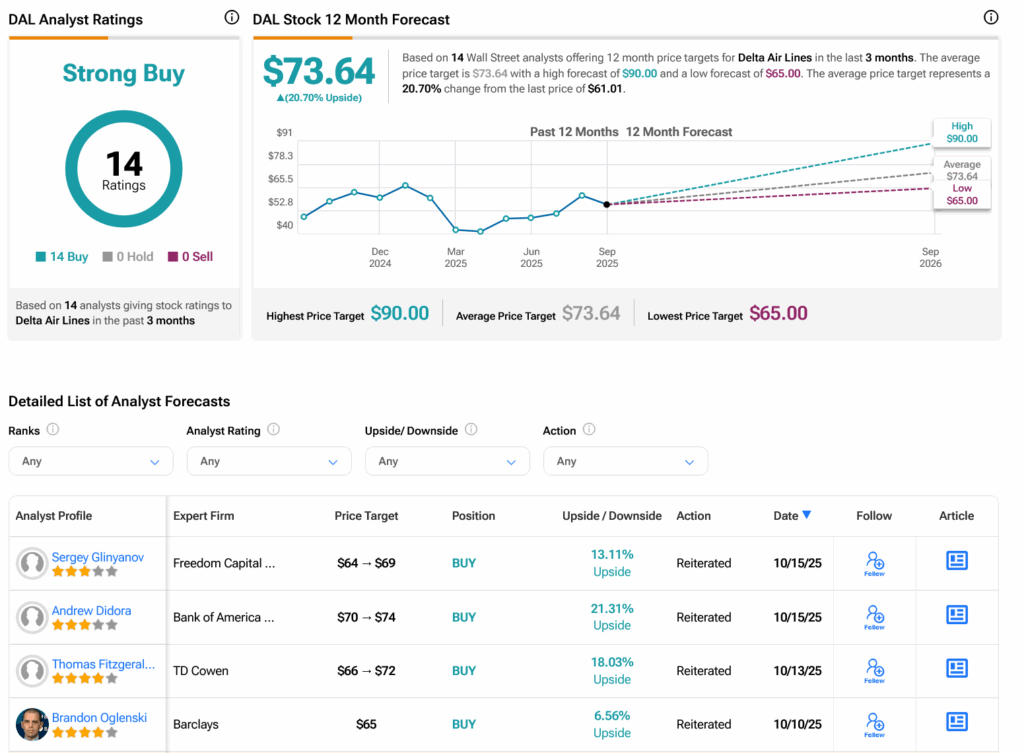

Turning to Wall Street, analysts have a Strong Buy consensus rating on DAL stock based on 14 Buys assigned in the past three months, as indicated by the graphic below. After a 14.03% rally in its share price over the past year, the average DAL price target of $73.64 per share implies 20.7% upside potential.