Lululemon Athletica (NASDAQ:LULU) is planning to divest Mirror, an at-home fitness company it acquired in 2020, Bloomberg reported. Lululemon, a manufacturer of activewear, is in discussions with a consultant about how to create buyer interest in the business.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Lululemon acquired Mirror when the at-home fitness trend was at its peak due to restrictions imposed during the pandemic. As daily life returned to normal, the demand for fitness equipment gradually declined.

It’s important to note that Lululemon incurred $443 million in impairment costs for the Mirror business in the fourth quarter of 2022. Additionally, the hardware sales for the quarter fell short of Lululemon’s projections.

Additionally, the company’s move supports its objective to change Lululemon Studio’s focus from a hardware-based company to a provider of digital app-based services. The new application is actually anticipated to debut this summer with a lower subscription fee.

Is LULU Stock a Buy or Sell?

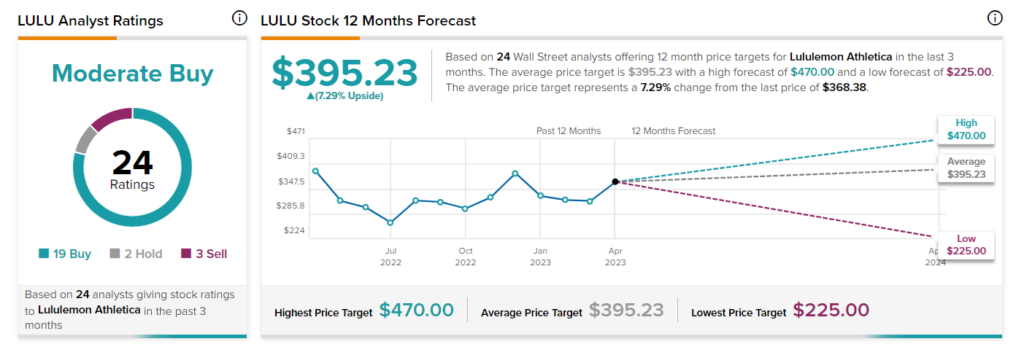

LULU stock has a Moderate Buy consensus rating on TipRanks. This is based on 19 Buys, two Holds, and three Sells. The average price target of $395.23 implies 7.3% upside potential from current levels.

Furthermore, the stock carries a “Perfect 10” Smart Score on TipRanks. It is worth mentioning that shares with a Smart Score of ten have historically outperformed the S&P 500 Index (SPX) by a wide margin.