For some people, including some investors, climate issues are a very serious matter that impacts how they make investments. With new word coming out that clothing retailer Lululemon (NASDAQ:LULU) isn’t doing very well on the climate front, some investors might be reconsidering. Indeed, the latest word from Stand.earth, a “climate advocacy group,” revealed that Lululemon’s total emissions were on the rise. This came after Lululemon promised to cut emissions, so the end result was a complete turnaround and backward progression.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Though there’s still time for Lululemon to be within its hoped-for expectations—it signed a charter with 13 other fashion companies pledging to cut emissions in half by 2030—it’s not exactly progressing the way it might have liked. In fact, the Stand.earth report revealed that, while some brands were reducing emissions as hoped, Lululemon’s were actually up 10% from where they originally were.

Carrying On Anyway

While some would prefer if Lululemon simply fell on its sword to cut off its carbon emissions, Lululemon carried on with the business of making money for its shareholders instead. A Jing Daily report noted that Lululemon had one of the best branded virtual experiences of 2023, a combined effort between itself and Emperia, a digital store platform. Together, Lululemon and Emperia offered users a set of virtual try-on experiences and a set of interactive workouts that got users up, moving, and engaged. Meanwhile, Lululemon also showed off its Boxing Week event with after-Christmas deals that should put a little extra bump into its holiday shopping figures.

Is LULU a Good Stock to Buy?

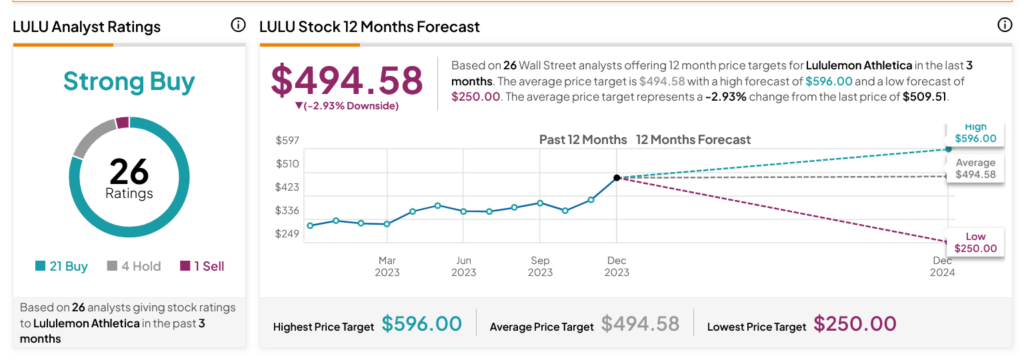

Turning to Wall Street, analysts have a Strong Buy consensus rating on LULU stock based on 21 Buys, four Holds, and one Sell assigned in the past three months, as indicated by the graphic below. After a 60.79% rally in its share price over the past year, the average LULU price target of $494.58 per share implies 2.93% downside risk.