Word on the street is that Lululemon (NASDAQ:LULU) might be looking to sell its at-home fitness venture, Mirror, with competitor Hydrow being considered as a potential buyer. Apparently, several parties have reached out to Hydrow to see if they’re interested in snapping up Mirror. However, it’s still up in the air whether the private startup, famous for its connected rowing machines, is keen on the idea. Lululemon took the plunge and acquired Mirror for a cool $500 million back in June 2020, banking on the at-home fitness trend staying strong even after the COVID-19 pandemic.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

But as it turns out, Mirror has been weighing Lululemon down. The company revealed a whopping $443 million in impairment charges tied to Mirror during the three-month period that ended on January 29th, mainly because hardware sales didn’t quite hit the mark. So, Lululemon has decided to change tack, moving away from hardware and instead announcing plans to launch a digital fitness app this summer.

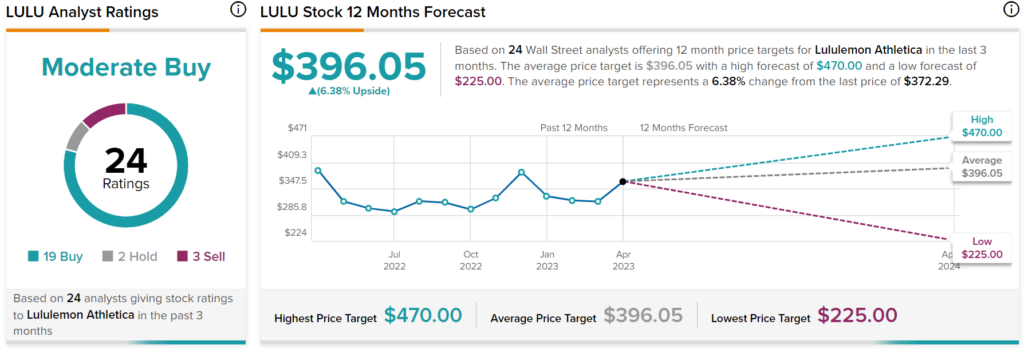

Turning to Wall Street, LULU stock has a Moderate Buy consensus rating based on 19 Buys, two Holds, and three Sells assigned in the past three months.