Athletic apparel retailer Lululemon Athletica Inc. (NASDAQ: LULU) has reported mixed results for the fourth quarter ended January 30, 2022, as earnings surpassed but revenues missed estimates.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Following the results, shares of the company rose 7.9% to close at $371 in Tuesday’s extended trading session.

Revenue & Earnings

The company reported quarterly net revenues of $2.1 billion, up 23% year-over-year. A year-over-year rise of 32% and 17% in comparable store sales and direct-to-consumer net revenue, respectively, drove the overall growth in net revenues. Yet, the figure failed to surpass the consensus estimate of $2.13 billion.

The company’s earnings per share (EPS) for the quarter stood at $3.37, which denotes a rise of 30.6% from the same quarter last year. Further, the figure topped the consensus estimate of $3.27 per share.

Other Operating Metrics

The company’s gross profit witnessed a rise of 22% from the prior year to $1.2 billion. However, the gross margin declined 50 basis points to 58.1%.

Yet, operating margin and adjusted operating margin rose 120 basis points and 90 basis points to 27.7% and 27.8%, respectively.

Notably, during the quarter, the company opened 22 net new company-operated stores, ending the quarter with 574 stores.

Share Buyback

On March 23, the company’s board authorized a new stock repurchase program of up to $1 billion of the company’s common shares.

Guidance

For the first quarter, the company expects revenues between $1.525 billion and $1.550 billion versus the consensus estimate of $1.41 billion. Similarly, for the Fiscal Year 2022, the company forecasts revenues to be in the range of $7.490 billion to $7.615 billion. The consensus estimate for the same is pegged at $7.3 billion.

The company forecasts first-quarter EPS in the range of $1.38 to $1.43 against the consensus estimate of $1.29. For the Fiscal Year 2022, the EPS is expected to be in the range of $9.15 to $9.35. The consensus estimate for the same is $9.06 per share.

Management Commentary

The CEO of Lululemon Athletica, Calvin McDonald, said, “2021 was another successful year for lululemon, which speaks to the enduring strength of our brand and our ability to deliver sustained growth across the business. We are proud that we passed the $6 billion in annual revenue milestone for the first time, and successfully achieved our Power of Three growth target ahead of schedule. This was especially impressive given the challenging macro backdrop. We are entering the new year from a position of strength, which we’ll build upon to continue delivering for our guests and shareholders in the years to come.”

Stock Rating

Post the earnings, J.P. Morgan analyst Matthew Boss reiterated a Buy rating on the stock with a price target of $450, which implies upside potential of 30.8% from current levels.

The analyst remains optimistic about the company’s recent foray into the footwear space.

Consensus among analysts is a Moderate Buy based on 13 Buys, six Holds and one Sell. LULU’s average price target of $418.61 implies upside potential of 21.7% from current levels. Shares have gained 8.5% over the past year.

Website Traffic

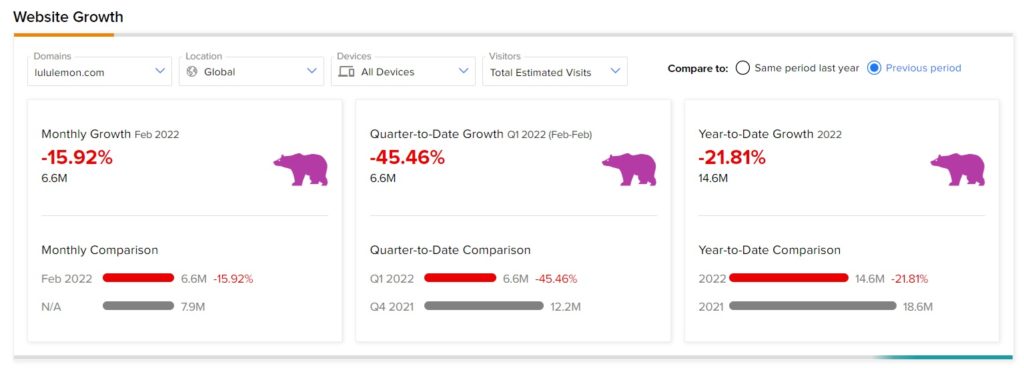

TipRanks’ Website Traffic Tool, which uses data from SEMrush Holdings (SEMR), the world’s biggest website usage monitoring service, offers insight into Lululemon Athletica’s performance this quarter.

According to the tool, the Lululemon Athletica website recorded a 15.92% monthly decline in global visits in February, compared to the same period last year. Further, the footfall on the company’s website has declined 21.81% year-to-date, compared to the previous year.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

GM Bets on New Organization in EV Race

XPeng’s Q4 Numbers Impress Analysts

Walmart Curtails its Cigarette Business