Shares of Lululemon (NASDAQ:LULU) gained over 5% in after-hours trading after the company reported earnings for its fourth quarter of Fiscal Year 2022. Earnings per share came in at $4.40, which beat analysts’ consensus estimate of $4.26 per share.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Sales increased by 30% year-over-year, with revenue hitting $2.8 billion. This beat analysts’ expectations of $2.7 billion.

Lululemon saw overall sales climb, but individual divisions offered some noteworthy twists. Comparable store sales were up 17% on a constant dollar basis. However, direct-to-consumer net revenue was up a whopping 39% on that constant dollar basis. Direct-to-consumer net revenue now accounts for 52% of all net revenue, up from 49% in 2021’s fourth quarter.

Further, Lululemon opened 32 new company-operated stores this quarter, which brings it to a grand total of 655 stores.

For the first quarter, management expects net revenue to hit between $1.89 billion and $1.93 billion and EPS figures to come in between $1.93 and $2. For reference, consensus estimates expect $1.85 billion in revenue and $1.64 in EPS.

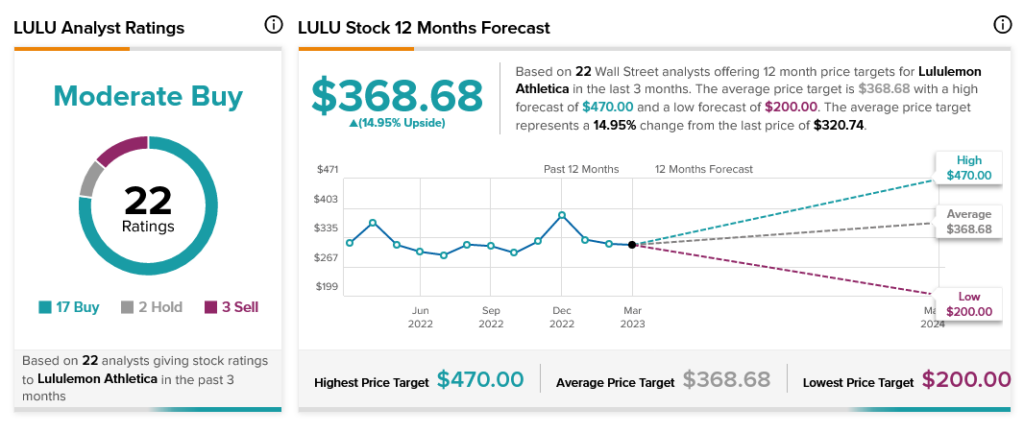

Overall, Wall Street has a consensus price target of $368.68 on Lululemon, implying 14.95% upside potential, as indicated by the graphic above.