Shares of electric vehicle maker Lucid Group (NASDAQ:LCID) surged in the pre-market session today after the company slashed the prices of its Air luxury sedans ahead of the holiday season, according to Reuters. The company is slated to report its third-quarter results tomorrow.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Lucid’s Air Touring sedan is now available at $87,500, down from the earlier $95,000. The company also lowered the price of its Grand Touring model to $115,600 from $125,600. The price cuts come as EV companies face tapering demand amid elevated interest rates and cutthroat price competition.

The challenging industry environment has led to a nearly 37% slump in Lucid shares over the past six months. However, the company has seen a dose of liquidity from the Public Investment Fund of Saudi Arabia. In September, Lucid opened its first international car manufacturing facility in Saudi Arabia.

The EV manufacturing plant, a first for Saudi Arabia, is expected to have an annual production capacity of 5,000 vehicles and will initially reassemble Lucid Air Vehicle kits produced in the U.S. Subsequently, Lucid plans to transition the facility to complete build unit production after 2025 and expand the annual capacity to 150,000 vehicles.

Tomorrow, Wall Street largely expects Lucid to post an EPS of -$0.36 on revenue of $185.1 million for the third quarter. In the comparable year-ago period, Lucid’s EPS of -$0.40 had missed analysts’ expectations by a wide margin of $0.09. The company has been consistently churning out losses since its market debut in 2020.

Is Lucid Stock Expected to Go Up?

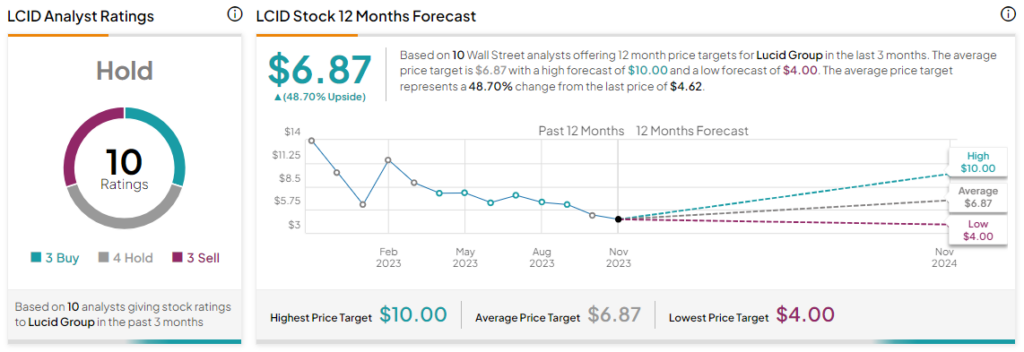

Meanwhile, the Street has a Hold consensus rating on Lucid. The average LCID price target of $6.87 implies a 48.7% potential upside.

Read full Disclosure