Electric vehicle maker Lucid Group (NASDAQ:LCID) landed quite a win today with new commentary from Bank of America Securities analysts. However, it wasn’t sufficient to give Lucid Group much of a leg up in the market. The company lost 2.6% in trading on Thursday, though after-hours trading was subdued.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Bank of America Securities left Lucid Group alone for a while but came back in grand style. BofA put a Buy rating on the company and also offered up a $21 per share price target. That’s almost three times the company’s share price as of closing on Thursday. BofA’s price target, meanwhile, is based on a 4x multiple of sales.

The motivation behind that Buy rating and that price target was impressive as well. In a note to investors, BofA analysts declared Lucid to be “…one of the most attractive among the universe of start-up electric vehicle automakers…” That’s a big claim by itself.

However, BofA kept the love going by noting that the company’s management is more than sufficiently experienced to carry on and also has several pieces of the process in hand. In turn, that should get the company to commercial operations faster than most of its contemporaries in the field.

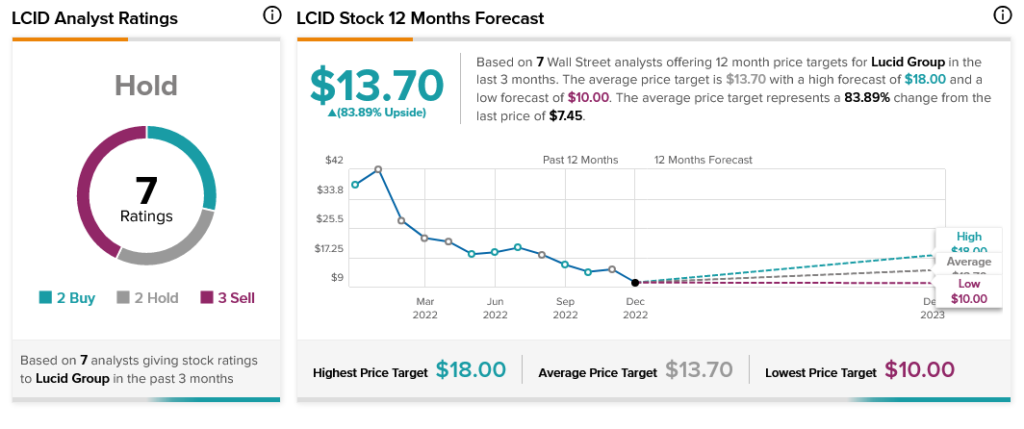

However, analysts consensus isn’t nearly as effervescent as BofA Securities’ is. The current consensus opinion on Lucid Group is a Hold, with more analysts recommending a Sell than a Buy or Hold. Balancing against that is an impressive upside potential of 83.89%.