Luxury electric vehicle (EV) maker Lucid Group (LCID) will report its Q3 results today, November 5. Based on options pricing, traders are expecting a 13.08% move in either direction after results, which is much higher than Lucid’s average post-earnings move (in absolute terms) of 6.8% over the past four quarters.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The 13.08% implied move shows that investors expect big swings as Lucid (LCID) reports its earnings tomorrow. The company has struggled with soft EV sales and high cash burn, raising concerns about its ability to scale profitably. Investors will look for signs of progress in production, deliveries, and margins, as well as updates on its upcoming Gravity SUV, which could help boost demand.

What Is Wall Street Expecting from LCID’s Q3 Earnings?

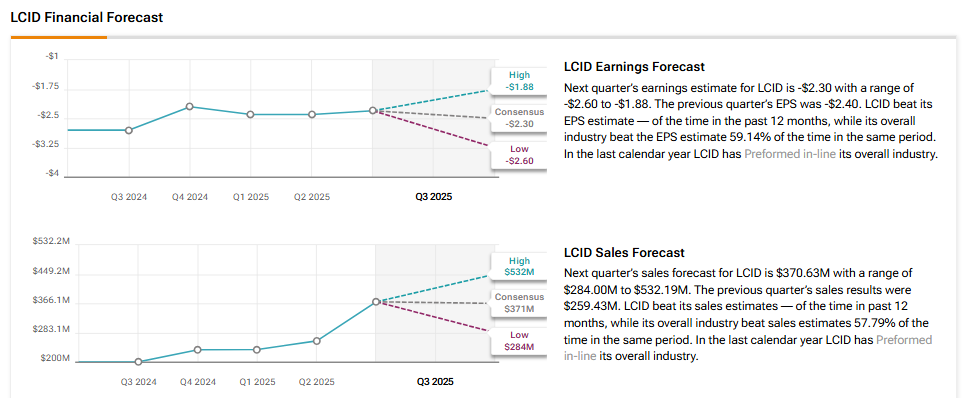

Wall Street expects Lucid to report Q3 loss of $2.30 per share, better than the $2.80 loss reported a year ago. Meanwhile, revenues are expected to rise by 85% from the same quarter last year, reaching $370.6 million, according to data from the TipRanks Forecast page.

Importantly, Lucid has missed earnings estimates five times in the past nine quarters, reflecting the struggles in the EV market.

Things to Know Ahead of Q3

On October 28, Lucid and chipmaker Nvidia (NVDA) teamed up to bring self-driving technology to Lucid’s upcoming electric vehicles. Lucid’s upcoming midsize vehicle will feature Level 4 autonomous driving powered by Nvidia’s DRIVE AGX platform and DriveOS. This means that the car will be fully self-driving, but only in certain areas or conditions, similar to how Waymo’s robotaxis work. Lucid plans to launch this vehicle in 2026.

Last month, Lucid announced that it is expanding its physical presence in California with the opening of two new Studio and Service Center locations: one in San Jose and the other in San Diego. These facilities will allow more customers to view and test the Lucid Air, as well as the new Lucid Gravity models.

Analysts’ Views on LCID Ahead of Q3 Results

Ahead of the Q3 print, Cantor Fitzgerald analyst Andres Sheppard raised his price target on Lucid to $26 from $20, while keeping a Neutral rating. He said he recently met with interim CEO Marc Winterhoff and CFO Taoufiq Boussaid to discuss key updates, including the Uber/Nuro robotaxi partnership, delivery goals, the Lucid Gravity SUV ramp-up, and the midsize platform launch set for late 2026. Sheppard believes the midsize launch could be a major turning point, helping Lucid boost production and improve margins.

Meanwhile, CFRA analyst Garrett Nelson downgraded Lucid stock from Sell to Strong Sell and maintained a price target of $10, implying a potential 44% downside from current levels. Nelson said the downgrade follows disappointing Q3 delivery and production results, which came in well below his estimates.

What Is the Price Target for LCID Stock?

The stock of Lucid Group has a consensus Hold rating among 11 Wall Street analysts. That rating is currently based on one Buy, eight Holds, and two Sell recommendations issued in the past three months. The average LCID price target of $25.00 implies 40.85% upside from current levels.