The London Stock Exchange Group (GB:LSEG) is moving further away from its roots as a marketplace for shares and deeper into the world of financial technology. Its latest step came Monday with news that it has partnered with Databricks, a California-based AI and data company, to roll out new AI-driven products for banks, asset managers, and traders.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The goal is to make LSEG’s analytics and risk platforms faster, more predictive, and harder to replace. By embedding Databricks’ technology into its Workspace platform, LSEG says clients will be able to run forecasts, check risks, and test trading strategies with a speed and precision not possible today.

Why the Deal Is Important

For LSEG, the deal is more than a technology upgrade. It is another move in its years-long effort to reinvent itself as a data and analytics powerhouse. The company bought Refinitiv for $27 billion in 2021, then signed a 10-year partnership with Microsoft (MSFT) to modernize its cloud backbone. Databricks is the next layer in that strategy and it puts LSEG in more direct competition with Bloomberg.

Bloomberg’s terminal has been the default tool for traders and analysts for decades. To break that grip, LSEG needs more than pricing feeds and news wires; it needs a platform that can analyze enormous volumes of market data and turn them into usable insights. The Databricks tie-up is pitched as exactly that.

What Changes for Clients

The pitch to clients is straightforward. Traders should be able to stress test a portfolio in seconds instead of hours. Asset managers will have tools to run backtests on years of trading history without waiting overnight for results. Risk teams could flag exposures or compliance breaches in real time. The aim is to cut down the lag between data and decision.

Emily Prince, LSEG’s Group Head of Analytics & AI, said the partnership will “unlock new levels of intelligence, efficiency, and compliance” across the business. For banks and investment managers who live on tight margins, shaving minutes or even seconds off decision cycles can make a material difference.

Success Is Not Guaranteed

Success is not guaranteed. Artificial intelligence in finance has always carried risk, from models that misfire to regulators skeptical of “black box” systems that cannot explain how they arrive at an answer. Rivals such as FactSet (FDS) and Bloomberg are rolling out their own AI products, which means LSEG will have to prove not just that its tools work, but that they work better.

Still, the momentum is evident. With data volumes exploding and market conditions shifting faster than ever, clients want more than raw feeds. They want intelligence that can be trusted. If LSEG delivers on that promise, the deal with Databricks could mark a turning point in its transition from an exchange into a global analytics giant.

Is LSEG Stock a Good Buy?

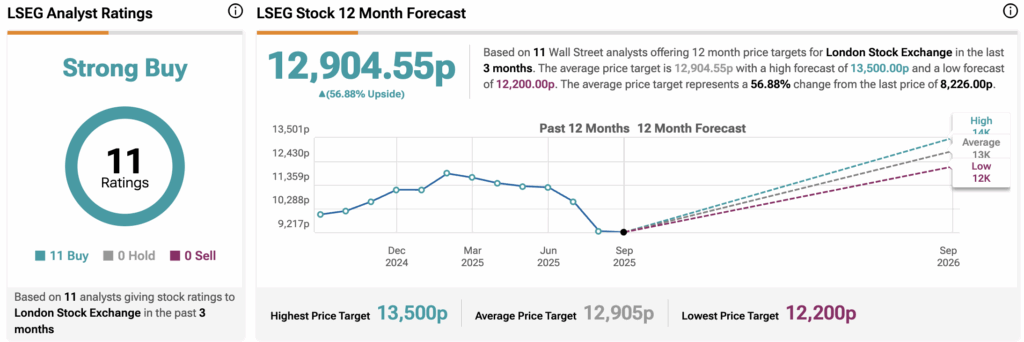

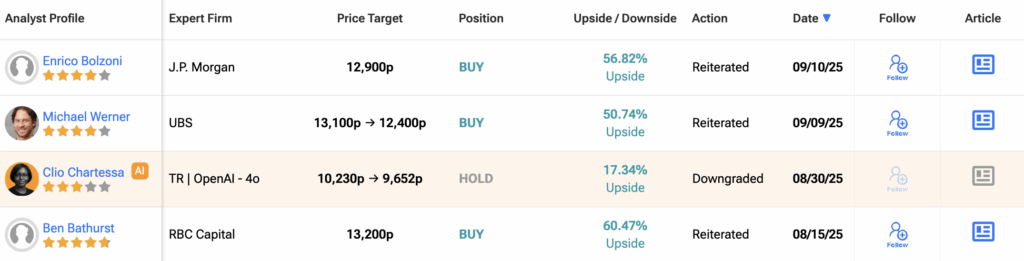

Wall Street is lining up behind the London Stock Exchange Group. According to TipRanks, all 11 analysts covering the stock in the past three months rate it a Buy, with no Holds or Sells. The consensus 12-month LSEG price target sits at 12,904.55p, which implies a potential 57% upside from the current price.