Building a portfolio of great dividend stocks means diversifying into a variety of industries. Investors might anticipate a big recovery in the home construction sector, which struggled last year amid high interest rates, but Lowe’s (NYSE:LOW) already appears to be on the comeback trail. Thus, I am bullish on LOW stock as a strong dividend pick.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Lowe’s operates a popular chain of retail stores that sell home-improvement products. Check out Lowe’s stock chart, and you’ll see that it has bullish momentum. Could there be fresh highs in the near future?

That’s a tough call, especially when mortgage rates are still elevated, and people aren’t always eager to start new home improvement projects. Nevertheless, Lowe’s had a chance recently to demonstrate its resilience, and a deep dive into the data ought to convince some dividend collectors to take a closer look at LOW stock.

Lowe’s Generous Yield and a Surprising Solar Deal

Suffice it to say, there’s been a lot going on with Lowe’s lately. Some people are worried about high mortgage interest rates, with the 30-year fixed U.S. mortgage rate reaching 8% briefly last year. Yet, despite this headwind, Lowe’s has maintained a steady dividend for the company’s loyal shareholders.

When I refer to the dividends page for Lowe’s on TipRanks, I can see immediately that the company likes to hike its quarterly dividend distributions on a fairly regular basis. Furthermore, Lowe’s pays a forward annual dividend yield of 1.9%. That’s pretty generous when compared to the consumer cyclical sector’s average dividend yield of around 1%.

Another crucial development is that Citigroup (NYSE:C) recently raised its price target on LOW stock from $199 to $236. That’s a vote of confidence from Citi, based on its expectation that Lowe’s would report earnings more or less in line with Wall Street’s quarterly EPS forecast — but more on that topic in a moment.

In addition to all of that, Lowe’s just embarked on a partnership that might surprise you. According to TheFly, Lowe’s will work with solar energy equipment company Sunrun (NASDAQ:RUN) to “provide households with solar and storage services inside of hundreds of Lowe’s stores across the country.” Thus, it appears that Lowe’s is bullish on home solar energy projects. If you’re also bullish on this niche market, you might want to add LOW stock (along with RUN stock) to your watch list for 2024.

Lowe’s Remains Resilient Despite High Mortgage Rates

Along with what was stated above, Lowe’s just released its financial results for the fourth quarter of Fiscal Year 2023. As it turns out, Lowe’s added another win to its strong track record of quarterly EPS beats.

It’s not a perfect quarterly report, as Lowe’s Q4-FY2023 revenue fell 17% year-over-year to $18.6 billion. On the other hand, this result surpassed analysts’ consensus revenue estimate by $130 million.

As we delve even deeper into the results, it’s apparent that Lowe’s was surprisingly resilient despite high mortgage rates. Remember how the Citigroup analysts expected that Lowe’s would report a more or less in-line EPS forecast? The company actually beat the consensus earnings estimate of $1.68 per share when Lowe’s reported earnings of $1.77 per share.

What about Fiscal Year 2024, though? Lowe’s management anticipates that the company will report full-year revenue of $84 billion to $85 billion and earnings of $12 to $12.30 per share. That’s below Wall Street’s consensus call for revenue of $85.36 billion and earnings of $12.68 per share.

Now, it’s up to you to decide whether you should be bothered by Lowe’s forward guidance. It’s below what the analysts expect, and that might bother some investors.

Personally, I tend to view Lowe’s muted outlook as a chance for the company to provide some positive surprises throughout the year. Besides, investors don’t seem to be very alarmed, as LOW stock is in the green today and appears ready to possibly break above the stubborn $250 resistance level.

Is LOW Stock a Buy, According to Analysts?

On TipRanks, LOW comes in as a Moderate Buy based on nine Buys and six Hold ratings assigned by analysts in the past three months. The average LOW stock price target is $240.93, implying 2.6% upside potential.

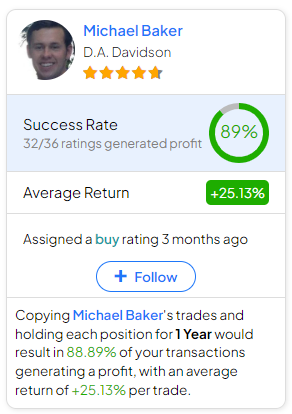

If you’re wondering which analyst you should follow if you want to buy and sell LOW stock, the most accurate analyst covering the stock (on a one-year timeframe) is Michael Baker of D.A. Davidson, with an average return of 25.13% per rating and an 89% success rate. Click on the image below to learn more.

Conclusion: Should You Consider LOW Stock?

Don’t expect Lowe’s stock to catapult past $250 tomorrow or next week. Lowe’s recovery needs to be slow and steady, as the company is a “fixer-upper.” Meanwhile, investors can chill out and collect Lowe’s quarterly dividend payments.

Lowe’s quarterly report isn’t perfect in every way, and the company’s forward guidance might bother some people. However, at least Lowe’s has improving top-line and bottom-line results and a solid earnings track record in spite of elevated interest rates. Consequently, do-it-yourself investors ought to take a look at LOW stock for a potential breakout in 2024, and I’m certainly considering it for a share position today.